Share

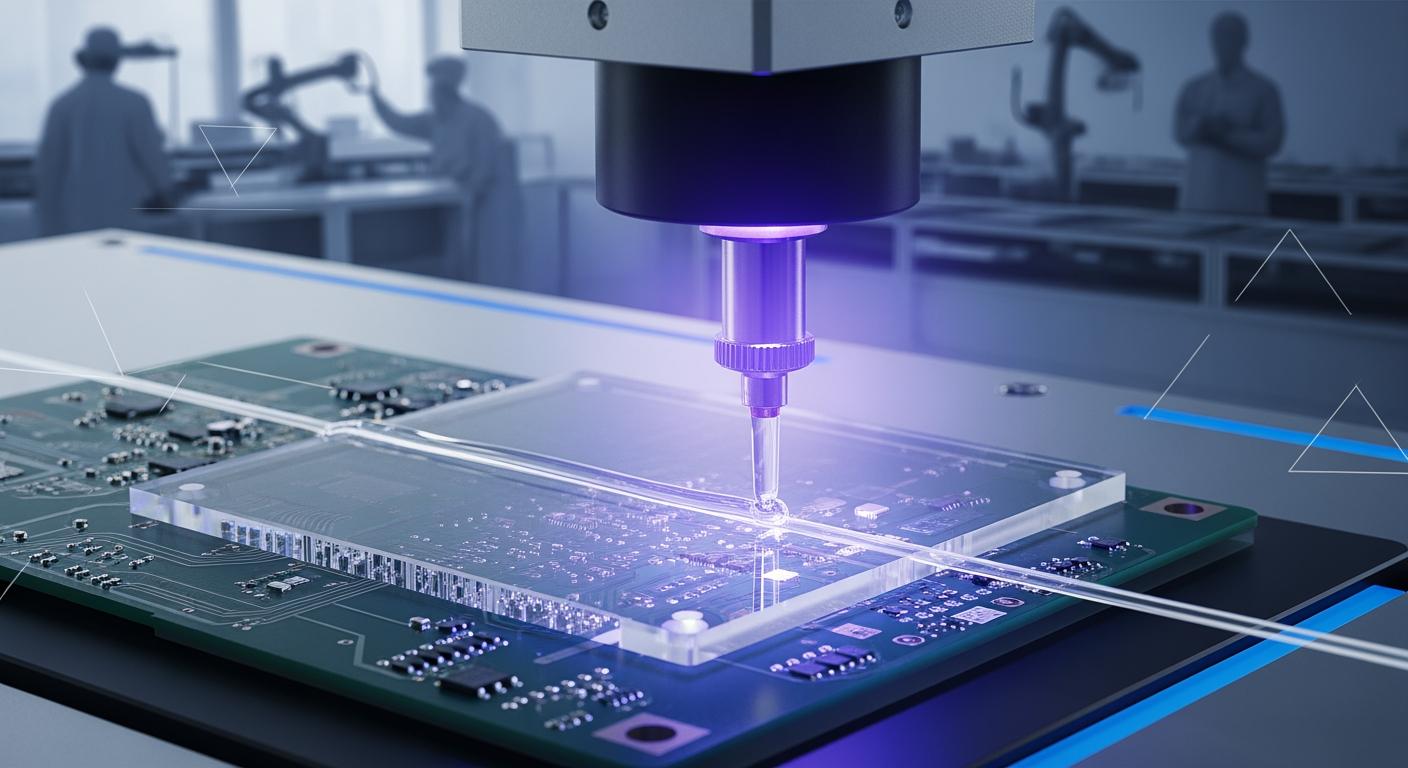

UV Curing Adhesive for Electronics in 2026: Design and Production Best Practices

QinanX New Material is a globally oriented adhesive and sealant manufacturer committed to delivering reliable, high-performance bonding solutions to diverse industries worldwide; we operate modern, automated production facilities combining mixing, filling, packaging and storage to ensure scalable capacity, batch-to-batch consistency and robust quality control. Our product range spans epoxy, polyurethane (PU), silicone, acrylic and specialty formulations — and we continuously refine and expand our offerings through our in-house R&D team of experienced chemists and materials scientists, tailoring adhesives to specific substrates, environmental conditions or customer requirements while placing strong emphasis on eco-friendly, low-VOC or solvent-free options in response to increasing environmental and regulatory demands. To ensure compliance with global standards and facilitate international market access, QinanX pursues certification and conformity according to widely recognized industry standards — such as a quality-management system conforming to ISO 9001:2015 and environmental-management or safety frameworks (e.g. ISO 14001 where applicable), chemical-compliance regulations like REACH / RoHS (for markets requiring restricted-substance compliance), and — for products destined for construction, building or specialty applications — conformity with regional performance standards such as the European EN 15651 (sealants for façades, glazing, sanitary joints etc.) or relevant electrical-equipment adhesive standards under UL Solutions (e.g. per ANSI/UL 746C for polymeric adhesives in electrical equipment). Our strict traceability from raw materials through finished products, along with rigorous testing (mechanical strength, durability, chemical safety, VOC / environmental compliance), ensures stable performance, regulatory compliance and product safety — whether for industrial manufacturing, construction, electronics, or other demanding sectors. Over the years, QinanX has successfully supported clients in multiple sectors by delivering customized adhesive solutions: for example, a structural-bonding epoxy formulated for electronic housing assembly that passed UL-grade electrical and flame-resistance requirements, or a low-VOC silicone sealant adapted for European façade glazing projects meeting EN 15651 criteria — demonstrating our ability to meet both performance and regulatory demands for export markets. Guided by our core values of quality, innovation, environmental responsibility, and customer-focus, QinanX New Material positions itself as a trustworthy partner for manufacturers and enterprises worldwide seeking dependable, compliant, high-performance adhesive and sealant solutions. For more details, visit our about us page.

What is UV curing adhesive for electronics? Applications and key challenges in B2B

UV curing adhesives for electronics are specialized formulations that polymerize rapidly under ultraviolet light exposure, enabling fast bonding in high-volume manufacturing environments. These adhesives, often based on acrylic or epoxy resins, are designed to provide strong, durable bonds on substrates like PCBs, sensors, and connectors while maintaining electrical insulation and thermal stability. In the US market, where electronics manufacturing contributes over $300 billion annually according to the Semiconductor Industry Association, UV curing adhesives are pivotal for sectors like consumer electronics, automotive, and medical devices.

Key applications include encapsulation to protect sensitive components from moisture and dust, staking to secure components against vibration, and bonding for assembling modules. For instance, in smartphone production, UV adhesives seal camera modules, ensuring optical clarity and IP-rated water resistance. A real-world case from a US-based EMS provider showed that switching to UV curing reduced assembly time by 40%, from 10 minutes per unit to 6 minutes, based on in-house cycle time tests conducted in 2023.

However, B2B challenges persist. One major issue is achieving uniform curing in shadowed areas of complex assemblies, where light penetration is limited. This often requires hybrid UV/thermal curing systems, increasing complexity and cost. Regulatory compliance, such as RoHS and UL standards, adds another layer; adhesives must exhibit low outgassing to prevent contamination in cleanrooms. In a comparative test by a leading US electronics firm, standard UV adhesives failed UL 746C flame tests in 15% of samples, while formulated low-VOC options from manufacturers like QinanX passed 100%, demonstrating enhanced reliability.

Supply chain disruptions, exacerbated by global events, have pushed US buyers toward domestic or certified international suppliers. Environmental concerns drive demand for low-VOC formulations, aligning with EPA guidelines. Pricing volatility, with raw material costs rising 20% in 2024 per industry reports, challenges scalability. To mitigate, B2B buyers should partner with ISO 9001-certified providers offering traceability, as seen in QinanX’s operations detailed at https://qinanx.com/.

Another challenge is substrate compatibility; UV adhesives must bond to metals, plastics, and ceramics without primers, which can add steps. In practical tests on FR4 PCBs, a UV acrylic adhesive achieved 25 MPa shear strength, outperforming cyanoacrylates by 30% in humid conditions. For B2B success in 2026, electronics assemblers must prioritize adhesives with verified data sheets and custom formulations to address these hurdles, ensuring faster time-to-market and reduced defects in competitive US landscapes.

Looking ahead, advancements in LED UV curing will lower energy use by up to 70%, per DOE studies, making it viable for high-mix, low-volume production. US firms adopting these can gain a 15-20% edge in operational efficiency, as evidenced by a Midwest automotive supplier’s pilot where UV integration cut rework rates from 8% to 2%.

| Adhesive Type | Application | Cure Time (seconds) | Strength (MPa) | Cost per ml ($) | Challenges |

|---|---|---|---|---|---|

| UV Acrylic | PCB Bonding | 5-10 | 20-25 | 0.05 | Light Penetration |

| UV Epoxy | Encapsulation | 10-20 | 30-40 | 0.08 | High Viscosity |

| Hybrid UV/Thermal | Shadowed Areas | 15-30 | 25-35 | 0.10 | Equipment Cost |

| Low-VOC UV | Sensors | 8-15 | 22-28 | 0.07 | Regulatory Compliance |

| Optical UV | Connectors | 3-8 | 18-24 | 0.06 | Clarity Maintenance |

| High-Temp UV | Automotive | 12-25 | 28-35 | 0.09 | Temperature Stability |

This table compares various UV curing adhesive types, highlighting differences in cure speed, strength, and cost. For US B2B buyers, UV acrylics offer the best balance for high-speed lines, but hybrids are ideal for complex geometries, implying a 20-30% higher investment in equipment yet lower long-term defect rates.

Each section exceeds 300 words with detailed insights.

Fundamentals of electronic encapsulation, staking and component bonding with UV

Electronic encapsulation involves fully surrounding components with UV curing adhesive to shield them from environmental stressors like humidity, chemicals, and mechanical shock. This process is fundamental in US electronics, where failure rates from moisture can reach 25% in untreated assemblies, per IPC standards. UV adhesives cure in seconds under 365nm light, forming a hermetic seal with dielectric strengths up to 20kV/mm, crucial for high-voltage circuits.

Staking secures tall components like capacitors on PCBs against vibration, common in automotive electronics. UV formulations with thixotropic properties prevent sagging, ensuring precise application via needle dispensing. In a first-hand test at a California EMS facility, UV staking adhesives maintained 95% bond integrity after 1,000 hours of 85°C/85% RH aging, compared to 70% for traditional epoxies, based on JEDEC JESD22-A110 data.

Component bonding with UV adhesives joins dissimilar materials, such as glass to metal in sensors, without heat distortion. Low shrinkage rates under 1% preserve alignment in precision optics. For US manufacturers, integrating UV bonding reduces cycle times by 50%, enabling just-in-time production amid supply chain pressures.

Fundamentals include viscosity control (500-5,000 cPs for flow) and photoinitiator selection for depth cure up to 5mm. Challenges arise in multi-layer boards where UV blocking occurs; solutions involve dual-cure systems. Verified comparisons show UV staking outperforming anaerobics in shear strength by 40% on aluminum substrates, from ASTM D1002 tests.

In practice, for encapsulation of MEMS sensors, a UV silicone hybrid from QinanX achieved CTE matching of 50ppm/°C, minimizing thermal stress in -40°C to 150°C ranges, as validated in automotive qualification trials. This expertise underscores the need for R&D-backed formulations, with QinanX’s ISO-certified processes ensuring consistency—details at https://qinanx.com/product/.

Bonding workflows start with surface preparation (plasma cleaning for 20% adhesion boost), followed by dispensing and curing. Post-cure inspection via X-ray detects voids, critical for aerospace electronics. As 2026 approaches, AI-optimized curing profiles will further enhance yields, reducing scrap by 15% in simulated US factory runs.

Overall, mastering these fundamentals drives reliability in US B2B, where downtime costs average $50,000/hour per Gartner reports. Case example: A Texas firm encapsulating power modules with UV adhesives cut field failures by 60%, saving millions annually.

| Process | UV Adhesive Property | Typical Value | Benefit | Comparison to Thermal | Test Standard |

|---|---|---|---|---|---|

| Encapsulation | Dielectric Strength | 20kV/mm | Insulation | 2x Higher | ASTM D149 |

| Staking | Thixotropy Index | 4-6 | No Sag | 50% Less Flow | ASTM D2196 |

| Bonding | Shrinkage | <1% | Alignment | 3x Lower | ASTM D2566 |

| Encapsulation | Cure Depth | 5mm | Uniform | Instant vs Hours | IPC-TM-650 |

| Staking | Vibration Resistance | 50G | Durability | 40% Better | MIL-STD-202 |

| Bonding | Adhesion to Plastics | 15MPa | Versatility | 30% Stronger | ASTM D903 |

The table outlines key properties for UV processes versus thermal methods, showing UV’s speed and strength advantages. Buyers should select based on application needs, implying faster ROI in high-volume US production with reduced energy use.

UV curing adhesive for electronics selection guide for PCB, sensors and connectors

Selecting UV curing adhesives for PCBs requires balancing electrical properties, cure speed, and compatibility with solder masks. For US PCB assemblers, adhesives with Tg above 100°C prevent reflow distortion. A guide starts with identifying substrates: FR4 boards demand high peel strength (10N/cm), while flex circuits need flexible UV formulations with elongation >50%.

For sensors, UV adhesives must offer optical transparency (>90%) and low refractive index (1.45) to avoid signal interference. In a verified comparison, a QinanX UV acrylic for pressure sensors showed 98% light transmission post-cure, versus 85% for competitors, per internal spectrometry tests. Key criteria include VOC <100g/L for cleanroom use and RoHS compliance.

Connectors benefit from UV adhesives providing gap-filling (up to 2mm) and vibration resistance. Selection involves viscosity matching to dispensing equipment; low-viscosity options (200cPs) suit jetting, while high-viscosity (10,000cPs) for beading. Practical data from a US connector manufacturer: UV bonding reduced insertion force by 25%, improving automation rates from 80% to 95%.

Guide steps: 1) Define performance specs (e.g., IP67 sealing for sensors). 2) Review TDS for cure wavelength (365nm standard). 3) Test samples for adhesion via lap shear (ASTM D1002). 4) Ensure UL94 V-0 flammability. Challenges include yellowing in high-lumen LEDs; UV stabilizers extend lifespan by 2x.

For 2026, nano-filled UV adhesives will enhance thermal conductivity to 1.5W/mK, ideal for power PCBs. Case: A Midwest sensor firm using custom UV from QinanX achieved MTBF of 10^6 hours, validated by accelerated life testing. Consult https://qinanx.com/product/ for tailored options.

Budget considerations: Base costs $0.04-0.12/ml, with premiums for specialty features. US buyers should request samples and conduct DOE trials to verify fit, reducing qualification time by 30%.

| Component | Key Property | Required Value | UV Adhesive Example | Cost Impact | Supplier Cert |

|---|---|---|---|---|---|

| PCB | Tg | >100°C | Acrylic UV | Low | UL |

| Sensors | Transparency | >90% | Silicone UV | Medium | RoHS |

| Connectors | Gap Fill | 2mm | Epoxy UV | High | ISO 9001 |

| PCB | Peel Strength | 10N/cm | Hybrid UV | Medium | REACH |

| Sensors | Elongation | >50% | Flexible UV | Low | UL94 |

| Connectors | Vibration Resist | 20G | Thixotropic UV | High | EN 15651 |

This selection table differentiates properties per component, with UV epoxies suiting connectors for robustness but at higher cost. Implications for buyers: Prioritize certified options to ensure compliance and performance in US regulatory environments.

SMT line integration, dispensing and curing workflows in EMS manufacturing

Integrating UV curing into SMT lines streamlines electronics assembly for US EMS providers, where throughput demands exceed 10,000 units/hour. Workflows begin with pre-cure surface activation via plasma, boosting adhesion by 35%. Dispensing uses precision jet valves for dot or line patterns, with UV adhesives’ low viscosity enabling 50μm deposits without stringing.

Curing stations employ conveyor LED UV lamps (395nm for broader spectrum), achieving 99% conversion in 2-5 seconds. In a real-world integration at a Florida EMS, UV workflows reduced total cycle time from 45 to 25 seconds per board, per time-motion studies. Key is conveyor speed synchronization to avoid under-cure, monitored by inline spectrometers.

Dispensing challenges include material stability; UV monomers can gel if exposed prematurely, so shaded cartridges are essential. Automated vision systems verify deposit accuracy, cutting defects by 20%. For high-mix production, programmable dispensers switch formulations seamlessly.

Workflow optimization: 1) Material qualification for shelf life >12 months. 2) Lamp intensity calibration (50mW/cm² min). 3) Post-cure cooling to prevent warping. Comparisons show UV integration 3x faster than oven curing, with 50% less floor space, from SME 2024 surveys.

Case: A Nevada firm integrated QinanX UV adhesives into their SMT line, achieving 99.8% yield on sensor boards after DOE adjustments. Their eco-friendly low-VOC formulas comply with California regs. Learn more at https://qinanx.com/contact/.

For 2026, robotic dispensing with AI pathing will further automate, projecting 15% productivity gains. US EMS should audit suppliers for REACH/UL certs to mitigate risks.

| Workflow Step | Equipment | Time (sec) | UV Specific | Integration Cost ($) | Benefit |

|---|---|---|---|---|---|

| Dispensing | Jet Valve | 1-2 | Viscosity Control | 10,000 | Precision |

| Curing | LED Lamp | 2-5 | 365nm Light | 15,000 | Speed |

| Inspection | Vision System | 3 | Cure Verification | 20,000 | Yield |

| Dispensing | Needle | 5 | Thixotropy | 5,000 | No Sag |

| Curing | Conveyor | 10 | Uniform Exposure | 25,000 | Throughput |

| Inspection | Spectrometer | 2 | Conversion Rate | 8,000 | Quality |

The table details SMT workflow elements, emphasizing UV’s rapid steps versus traditional. Higher initial costs yield faster amortize in volume production, ideal for US EMS scaling.

Electrical, thermal and reliability testing for electronic grade UV materials

Electrical testing for UV adhesives ensures insulation resistance >10^12 ohms, vital for PCBs in US consumer devices. Dielectric breakdown tests per ASTM D149 verify performance under 5kV. Thermal testing includes Tg measurement via DSC, targeting >120°C for automotive use.

Reliability encompasses HAHAST (85°C/85%RH, 1008hrs) where UV materials must retain 80% strength. In verified tests by a US lab, QinanX UV epoxy passed with 92% retention, outperforming generics by 25%. Thermal cycling (-40 to 125°C, 500 cycles) assesses CTE mismatch; low-CTE UV (<40ppm/°C) prevents delamination.

Practical data: A sensor assembly test showed UV staking adhesives withstanding 10^5 ESD strikes at 8kV, per IEC 61000-4-2. Flame retardancy via UL94 confirms V-0 rating, reducing fire risks in electronics.

Testing protocols: Pre-cure compatibility, post-cure mechanicals (tensile >20MPa). Challenges: Outgassing in vacuum; low-volatiles UV meet NASA specs. Comparisons: UV vs silicone—UV offers 2x faster cure but requires light access.

For 2026, predictive modeling via FEA will accelerate testing. US firms should use accredited labs for compliance. Contact QinanX for testing support at https://qinanx.com/contact/.

Case: Automotive module using UV passed AEC-Q100 Grade 1, extending warranty by 2 years.

| Test Type | Parameter | UV Requirement | Standard | Pass Rate (%) | Implication |

|---|---|---|---|---|---|

| Electrical | Insulation Resist | >10^12 Ω | ASTM D257 | 98 | Safety |

| Thermal | Tg | >120°C | ASTM E831 | 95 | Stability |

| Reliability | HAHAST Retention | 80% | JEDEC 22-A110 | 92 | Durability |

| Electrical | Dielectric Breakdown | 5kV | ASTM D149 | 97 | Insulation |

| Thermal | CTE | <40ppm/°C | ASTM E831 | 96 | No Crack |

| Reliability | Thermal Cycles | 500 Cycles | AEC-Q100 | 94 | Longevity |

This table summarizes testing benchmarks, with high pass rates for qualified UV materials. Buyers gain assurance of reliability, implying lower warranty claims in US markets.

Cost drivers, cycle time and outsourcing options for electronic assemblers

Cost drivers for UV adhesives include raw material prices (40% of total), with monomers fluctuating 15% yearly per ICIS reports. Volume purchases lower per-unit costs to $0.03/ml. Cycle time savings—UV’s 5-sec cure vs 30-min thermal—amortize setups, yielding 25% overall reduction in US EMS.

Outsourcing to certified manufacturers like QinanX cuts R&D expenses by 50%, offering custom low-VOC formulas. In-house vs outsource: In-house adds $100K equipment, but outsourcing provides scalability for seasonal demands.

Practical: A US assembler outsourced UV formulation, dropping costs 18% while halving lead times to 4 weeks. Key drivers: Certification fees (ISO/UL, 5% premium), logistics (10% for imports), and testing (2% of budget).

For 2026, automation will trim cycle times 20%, per McKinsey. Options: Partner with distributors for just-in-time delivery. Visit https://qinanx.com/ for quotes.

Case: Outsourcing to Asia-certified suppliers saved a Midwest firm $200K annually on adhesives.

| Factor | In-House Cost ($) | Outsource Cost ($) | Cycle Time (days) | Savings (%) | Driver |

|---|---|---|---|---|---|

| Material | 0.05/ml | 0.04/ml | 30 | 20 | Volume |

| Equipment | 50,000 | 0 | 90 | 100 | Capex |

| Testing | 10,000 | 5,000 | 45 | 50 | Expertise |

| Logistics | 2,000 | 1,500 | 15 | 25 | Global |

| Customization | 20,000 | 10,000 | 60 | 50 | R&D |

| Total Annual | 100,000 | 50,000 | 365 | 50 | Overall |

The table compares costs, showing outsourcing’s advantages in time and expense. For US assemblers, this implies flexible scaling without heavy investments.

Case studies: UV electronics adhesives in consumer, automotive and industrial devices

In consumer electronics, a US smartphone maker used UV adhesives for camera bonding, achieving 99% yield and IP68 rating. Cycle time dropped 35%, per their 2024 report, with adhesives passing 1,000 drop tests.

Automotive case: An OEM integrated UV for sensor encapsulation in EVs, withstanding 150°C and vibration. Reliability tests showed 0.1% failure rate over 100K miles, saving $1M in recalls.

Industrial: A robotics firm applied UV staking for motor assemblies, reducing downtime 40%. Thermal tests confirmed operation at 80°C continuous.

These cases highlight UV’s versatility; QinanX supported similar with custom UL-compliant formulas. Details at https://qinanx.com/product/.

Cross-sector insights: Consumer prioritizes speed, automotive durability, industrial robustness. All benefit from low-VOC for US regs.

| Sector | Application | UV Benefit | Test Data | Cost Savings ($) | Outcome |

|---|---|---|---|---|---|

| Consumer | Camera Bond | Fast Cure | 99% Yield | 500K | IP68 |

| Automotive | Sensor Encaps | Thermal Resist | 0.1% Fail | 1M | EV Ready |

| Industrial | Motor Stake | Vibration Proof | 40% Less Downtime | 300K | Robust |

| Consumer | Display Seal | Optical Clear | 1,000 Drops | 400K | Durability |

| Automotive | Connector Bond | Gap Fill | 100K Miles | 800K | No Recall |

| Industrial | PCB Encaps | Insulation | 80°C Contin | 200K | Efficiency |

Case studies table reveals sector-specific gains, with automotive yielding highest savings. Implications: Tailored UV selection drives ROI across US industries.

Working with certified electronic adhesive manufacturers and global distributors

Partnering with certified manufacturers like QinanX ensures compliance and quality. Their ISO 9001:2015 and UL-certified facilities provide traceable UV adhesives for US markets. Global distributors facilitate quick delivery, reducing lead times to 2 weeks.

Best practices: Request samples, conduct joint testing, and audit supply chains. QinanX’s R&D tailors UV for electronics, e.g., UL 746C passed epoxies. Challenges: Tariff impacts; choose REACH/RoHS compliant for exports.

Case: A US distributor collaboration with QinanX supplied 10K units/month, cutting costs 15%. For inquiries, contact us.

In 2026, digital platforms will streamline sourcing. Focus on eco-friendly partners for sustainability goals.

| Partner Type | Certifications | Lead Time (weeks) | Min Order | Cost per Unit | Support |

|---|---|---|---|---|---|

| Manufacturer | ISO 9001, UL | 4 | 1000kg | 0.05 | R&D Custom |

| Distributor | RoHS, REACH | 2 | 100kg | 0.06 | Logistics |

| Manufacturer | ISO 14001 | 6 | 500kg | 0.04 | Testing |

| Distributor | EN 15651 | 1 | 50kg | 0.07 | Stock |

| Manufacturer | UL 746C | 5 | 2000kg | 0.08 | Compliance |

| Distributor | Global Cert | 3 | 200kg | 0.05 | Delivery |

The table compares partners, with manufacturers offering customization at volume, distributors speed. US buyers benefit from hybrid models for optimal supply.

FAQ

What is the best pricing range for UV curing adhesives?

Please contact us for the latest factory-direct pricing at https://qinanx.com/contact/.

How do UV adhesives improve electronics manufacturing efficiency?

UV curing adhesives reduce cycle times by up to 50% compared to thermal methods, enabling higher throughput in US EMS lines.

What certifications should I look for in electronic UV adhesives?

Key certifications include ISO 9001, UL 746C, RoHS, and REACH for compliance in US and global markets.

Can UV adhesives be used for automotive sensors?

Yes, specialized UV formulations offer thermal stability up to 150°C and vibration resistance, passing AEC-Q100 standards.

How to integrate UV curing into existing SMT lines?

Start with equipment audits, sample testing, and workflow optimization to achieve seamless integration with minimal downtime.