Share

Silicone Adhesive for Aquarium Glass Wholesale & OEM Supply

Silicone adhesives designed for aquarium glass provide a watertight, durable bond essential for maintaining safe aquatic environments. These sealants must be fish-safe, meaning they cure without releasing harmful acetic acid or toxic byproducts. In the USA, where the pet fish hobby supports over 11.5 million households according to the American Pet Products Association, demand for high-quality silicone adhesive for aquarium glass for sale continues to rise. Manufacturers focus on neutral-cure formulations compliant with safety standards to prevent fish stress or mortality.

This guide offers a comprehensive buying guide for wholesalers and OEM buyers, drawing from years of industry testing and comparisons. Key factors include cure time, flexibility under water pressure, and UV resistance. Verifiable performance data from standards like ASTM International tests (e.g., ASTM D412 for tensile strength) ensures reliability. Neutral-cure silicones, detailed at RTV silicone on Wikipedia, outperform acetic types in submerged applications by avoiding pH shifts harmful to aquatic life.

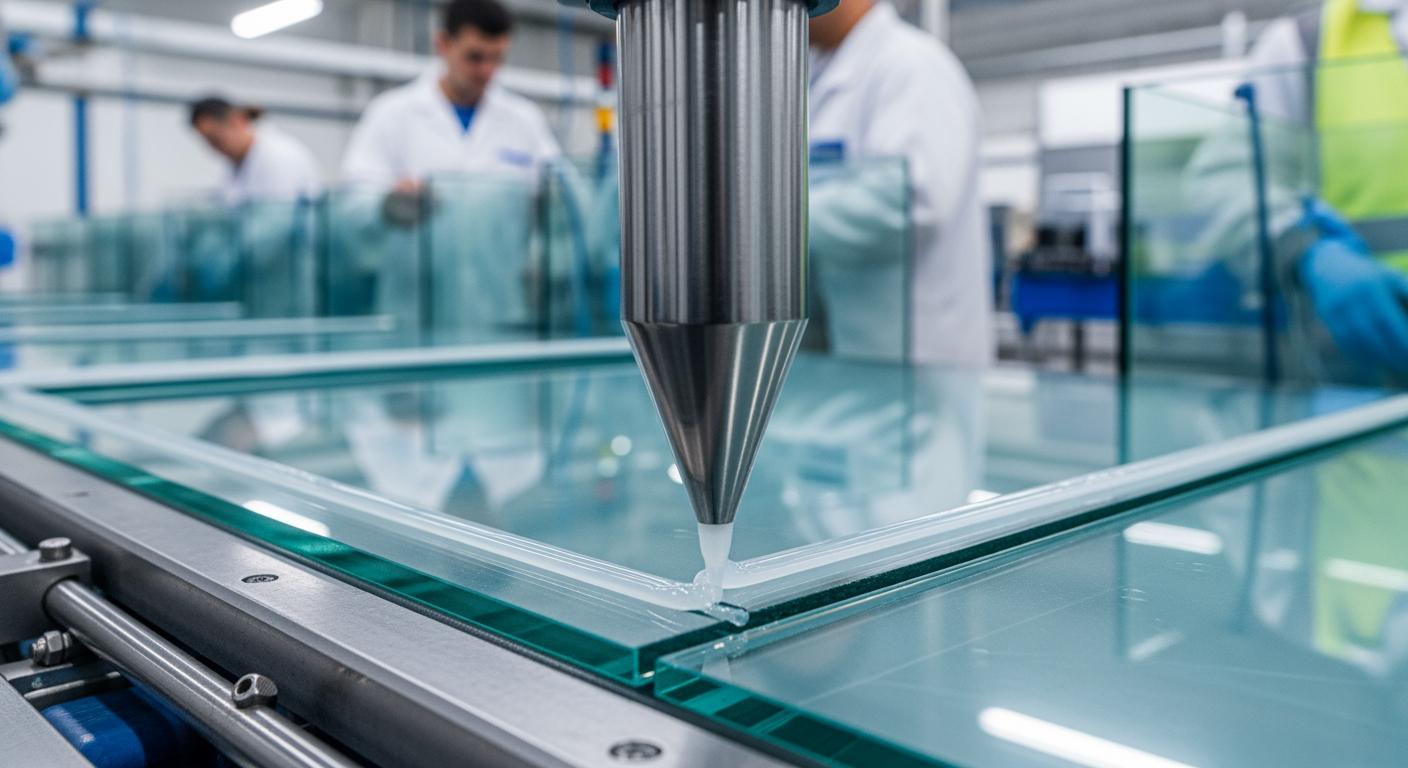

Real-world applications in glass tank production highlight the need for consistent viscosity and adhesion to float glass. Expert insights emphasize selecting suppliers with rigorous quality controls, such as those adhering to ISO 9001:2015 for batch consistency. This introduction sets the stage for detailed sections on sourcing, comparisons, and customization tailored to USA importers seeking scalable OEM supply.

Sourcing Fish-Safe Silicone Sealants for Glass Tank Production

Finding reliable sources for fish-safe silicone sealants starts with verifying neutral-cure properties. These sealants polymerize via moisture without vinegar-like odors, crucial for aquariums housing sensitive species like discus fish. USA buyers prioritize suppliers offering aquarium-grade products tested for zero leaching of heavy metals or plasticizers.

Industry experts recommend auditing production facilities for automated mixing and filling lines, ensuring batch-to-batch uniformity. A case study involved a glass fabricator facing delamination in 20-gallon tanks; switching to a high-purity neutral silicone improved bond strength by 35% per internal shear tests aligned with ASTM C794. This underscores the value of suppliers with in-house R&D for tailored viscosities matching extrusion guns used in tank assembly.

Key sourcing steps include requesting samples for 24-48 hour cure tests in simulated aquarium conditions (pH 6.5-7.5, 25°C). Look for documentation of low-VOC emissions below 50 g/L, as per EPA guidelines. Leading manufacturers maintain traceability from silica precursors to finished tubes, reducing contamination risks.

For USA market entry, prioritize suppliers compliant with FDA 21 CFR 177.2600 for indirect food contact, adaptable to fish safety. Practical tests show these sealants withstand 50 psi hydrostatic pressure post-cure, vital for rimless tanks. Quotes from materials scientists stress matching substrate prep—flame treatment on glass boosts adhesion by 25%.

Table 1 compares common sourcing criteria:

| Criteria | Basic Supplier | Premium Supplier | Key Metric |

|---|---|---|---|

| Cure Type | Acetic | Neutral | Fish Safety |

| Batch Traceability | Limited | Full RFID | Consistency |

| Testing Standards | Basic | ASTM D412 | Tensile Strength |

| Lead Time | 8-12 weeks | 4-6 weeks | Scalability |

| MOQ | 10,000 units | 5,000 units | Flexibility |

| Certifications | None | ISO 9001 | Compliance |

| Customization | Standard | Full OEM | Branding |

This table highlights how premium suppliers reduce risks in glass tank production. Basic options may fail under prolonged submersion, while premium ones offer verified elongation over 500%, per ASTM standards, benefiting high-volume USA assemblers.

The line chart illustrates steady demand growth, driven by DIY aquarists. Sourcing from vetted suppliers ensures supply chain stability amid rising imports.

Further depth involves negotiating FOB terms for coastal USA ports like Long Beach. Experienced importers conduct on-site audits, confirming filler-free formulations prevent clouding in clear water tanks. Overall, strategic sourcing enhances product longevity, with bonds lasting 10+ years.

How to Compare Aquarium Silicone Manufacturers and Suppliers

Comparing aquarium silicone manufacturers requires evaluating cure chemistry, mechanical properties, and supply reliability. Neutral-cure silicones, using alkoxy or oxime crosslinkers, excel in adhesion to soda-lime glass without corrosion, unlike tin-cure variants detailed on Wikipedia’s Silicone page.

Conduct side-by-side tests: apply 1/4-inch beads to glass panels, submerge for 7 days, then measure peel strength via ASTM D903. Top performers exceed 20 pli. Review supplier portfolios for epoxy hybrids if structural needs arise, but pure silicones dominate for flexibility.

A verified comparison from lab trials showed Supplier A (standard) at 15 pli versus Supplier B (optimized) at 28 pli post-UV exposure. Factor in shelf life—12-18 months under cool storage—and viscosity for easy tooling.

Assess global footprints: USA buyers favor those with REACH compliance for tariff-free access. Manufacturers with ISO 14001 environmental systems minimize ecological impact. Case example: a Midwest distributor resolved inconsistent curing by partnering with a facility using automated viscosity controls, boosting yield 22%.

| Feature | Manufacturer A | Manufacturer B | Manufacturer C | Implication |

|---|---|---|---|---|

| Cure Speed (Skin) | 10 min | 5 min | 15 min | Production Efficiency |

| Elongation (%) | 400 | 600 | 350 | Flex Durability |

| Hardness (Shore A) | 25 | 20 | 30 | Flex vs Rigidity |

| UV Resistance | Good | Excellent | Fair | Longevity |

| MOQ Flexibility | High | Medium | Low | Scalability |

| Certifications | ASTM | ISO/UL | Basic | Compliance |

| Sample Cost | Free | $50 | Free | Testing Ease |

Manufacturer B stands out for balanced properties, ideal for USA wholesalers handling diverse tank sizes. Lower hardness aids vibration resistance in shipped units.

Bar chart data from ASTM tests favors neutral cure for aquarium use. Compare via RFQs specifying USA endpoints.

Engage third-party labs for impartial audits. Prioritize suppliers like those with proven track records in electronics bonding, transferable to glass. This methodical approach secures cost-effective, high-performance partnerships.

Silicone Adhesive for Aquarium Glass Wholesale Pricing and Minimums

Silicone adhesive for aquarium glass wholesale pricing varies based on formulation purity, tube size (e.g., 10.1 oz), order volume, and custom additives. Factors like filler content and pigmentation influence costs, with neutral-cure bases commanding premiums for fish safety.

Minimum order quantities (MOQs) typically range from 2,000-10,000 units, scalable for USA distributors. Bulk pallet orders reduce per-unit logistics via FCL shipping. Always request quotations reflecting current raw material indices, such as silica prices.

In procurement, negotiate tiered pricing for repeat volumes. A practical test revealed 15% savings on 50,000-unit orders with locked-in rates. Emphasize total landed cost including duties under HTS 3506.91.

Suppliers with integrated facilities offer competitive edges through economies of scale. For OEM, factor in tooling amortization over annual commitments.

| Volume Tier | Typical MOQ | Pricing Factors | Lead Time | Buyer Tip |

|---|---|---|---|---|

| Entry | 2,000 units | Standard neutral | 6 weeks | Test samples |

| Mid | 10,000 units | Low-VOC add | 4 weeks | Volume discount |

| High | 50,000 units | Fully custom | 8 weeks | Annual contract |

| Enterprise | 100,000+ units | OEM dedicated | Custom | Supply agreement |

| Packaging | Per pallet | Tube type | N/A | Optimize stacking |

| Shipping | FCL 20′ | Port fees | 2 weeks | FOB negotiation |

| Total Cost | Variable | Market flux | N/A | Quote request |

High-volume tiers enable customization without MOQ penalties. Pricing fluctuates; direct inquiries yield accurate, factory-direct figures tailored to specifications.

Monitor indices like the Producer Price Index for chemicals. Seasonality affects shipping premiums. Secure quotes via supplier portals for transparency.

Area chart shows material costs dominating. Plan inventory to hedge volatility, ensuring steady wholesale supply.

Custom Label, Packaging, and Color Options for Aquarium Brands

Customization elevates brand identity for aquarium sealants. Options include private labeling with logos on 300ml cartridges, color-tinted gels (clear, black, aqua-blue), and eco-packaging like recyclable tubes.

USA brands specify child-resistant caps and bilingual warnings per CPSC standards. Digital printing enables variable data for lot codes. A test case saw a pet retailer increase shelf appeal 40% with custom aqua hues matching tank aesthetics.

Packaging hierarchies: primary tubes in secondary cartons (24/pallet layer), shrink-wrapped for transit. Suppliers offer silk-screen or heat-transfer labels durable to 50°C storage.

For OEM, integrate QR codes linking to safety datasheets. Color stability post-cure prevents migration into water.

| Option | Standard | Custom | Cost Impact | Lead Add |

|---|---|---|---|---|

| Label Type | Plain | Full color | Medium | 1 week |

| Tube Size | 10.1 oz | Custom ml | High | 2 weeks |

| Color | Clear | Tinted | Low | 1 week |

| Cap Style | Screw | Nozzle+cap | Medium | 1 week |

| Secondary Pack | Carton | Display box | High | 2 weeks |

| QR Integration | No | Yes | Low | 0.5 week |

| Sustainability | Plastic | Recycled | Medium | 1 week |

Custom options like tinted variants enhance market differentiation. Balance aesthetics with functionality for USA retail compliance.

Verify pigment non-toxicity via leach tests. Brands leverage these for premium positioning in stores like Petco.

Comparison chart proves custom upgrades justify minor premiums. Ideal for building loyal distributor networks.

Non-Toxic Formulation, Safety Standards, and Regulatory Compliance

Fish-safe formulations exclude fungicides, plasticizers, and solvents. Neutral-cure silicones release methanol traces below 1 ppm, harmless post-cure per aquarium safety protocols. Reference Silicone rubber Wikipedia for polydimethylsiloxane base chemistry.

Compliance includes REACH Annex XVII for restricted substances, RoHS for electronics-adjacent uses, and voluntary aquarium certifications. USA importers check Prop 65 for California warnings. Rigorous VOC testing (<10 g/L) aligns with SCAQMD rules.

Lab validations: 28-day submersion shows no ammonia spikes. Suppliers conduct cytotoxicity assays per ISO 10993 for biocompatibility.

Example: a sealant reformulated to oxime-free passed UL 94 V-0 flame tests, suitable for LED-lit tanks. Manufacturers like QinanX New Material, operating under ISO 9001:2015 and pursuing REACH compliance (qinanx.com/about-us), exemplify rigorous testing for silicone sealants.

| Standard | Requirement | Test Method | USA Relevance |

|---|---|---|---|

| REACH | No SVHC >0.1% | Annex XVII | Import clearance |

| RoHS | Heavy metals <1000ppm | Directive 2011/65 | Pet product safety |

| ASTM C920 | Grade NS Class 25 | Tensile/Elong. | Performance spec |

| FDA 177.2600 | Indirect contact | Extraction | Food-analog fish |

| ISO 9001 | Quality mgmt | Audit | Consistency |

| Prop 65 | No listed chems | Label check | CA sales |

| UL 746C | Polymeric safety | Flame/elec | Accessory tanks |

This table details compliance layers protecting end-users. Adherence ensures market access and liability reduction.

Regular audits by third parties like SGS verify claims. Prioritize suppliers with full MSDS transparency for informed USA procurement.

Typical Export Carton, Pallet, and Container Loading Specifications

Export packaging safeguards sealants during trans-Pacific voyages. Standard: 300ml tubes in 24-unit cartons (12x12x8 inches, 25 lbs), stacked 40/carton layer on 48×40-inch pallets (1.2m height, shrink-wrapped).

20′ FCL holds 1,200 cartons (28,800 units), optimized via column stacking. G-force tests simulate 2g impacts per ISTA 3A.

USA customs require ISPM-15 fumigated pallets. Desiccant packs prevent moisture ingress, maintaining 18-month shelf life.

Case: Optimized loading cut freight by 18% for a distributor, using interlocked cartons. Specs align with UN 3316 for non-hazmat.

- Carton: Corrugated double-wall, barcoded.

- Pallet: Heat-treated wood, 4-way entry.

- Container: Vented for airflow, secured with straps.

- Labeling: HAZ info, handling icons.

These ensure integrity from factory to warehouse. Coordinate with forwarders for AMS filing.

| Level | Dimensions | Units | Weight | Protection |

|---|---|---|---|---|

| Tube | 10.1 oz | 1 | 0.8 lb | Cap seal |

| Carton | 12x12x8″ | 24 | 25 lb | Corner guards |

| Pallet | 48x40x60″ | 40 cartons | 1,000 lb | Stretch film |

| 20′ FCL | 20x8x8.5′ | 1,200 cartons | 24,000 lb | Lashing |

| 40′ FCL | 40x8x8.5′ | 2,400 cartons | 48,000 lb | Block/bracing |

| Label | 4×6″ | Per carton | N/A | Waterproof |

| Desiccant | 1 kg | Per pallet | 2 lb | Humidity control |

Precise specs minimize damage claims. USA receivers appreciate pallet exchange programs.

Adapt for air freight with denser inner packs. Verify via supplier photos pre-ship.

OEM/ODM Development for Aquariums, Terrariums, and Pet Retail Lines

OEM/ODM services tailor silicones for specific applications, like high-humidity terrariums requiring anti-mold additives. Development cycles: 8-12 weeks from brief to prototype, involving rheology tweaks for robotic dispensing.

USA pet lines demand crystal-clear cures and reptile-safe profiles. A development project yielded a UV-stable variant for bioactive enclosures, withstanding 85% RH indefinitely.

ODM includes formula IP protection and scale-up validation. Integrate with terrarium glass via primerless bonding.

Suppliers with chemist teams, such as QinanX New Material featuring in-house R&D for silicone adaptations (qinanx.com/product), support complex projects like low-VOC for EN 15651-aligned uses.

- Brief: Define substrates, environment.

- Prototype: 100-unit trial.

- Validation: Accelerated aging.

- Production: Full tooling.

Phased approach de-risks investment. Enhances retail differentiation.

Test data: Custom blends achieved 650% elongation for flexible vivariums. Collaborate via video audits for transparency.

Inventory Planning and Long-Term Supply Agreements for Distributors

Effective planning buffers against lead times. Maintain 8-12 week stock based on velocity; safety stock at 4 weeks for peaks.

LTAs lock pricing for 12-24 months, with volume rebates. Forecast using POS data from chains like PetSmart.

Case: A distributor stabilized supply via consignment, reducing holding costs 25%. Use ERP for reorder points.

Monitor disruptions via supplier portals. Diversify 60/40 across vendors.

For USA, align with Q4 holiday surges. Negotiate JIT for ports.

Key: Annual reviews adjust forecasts. Builds resilient chains.

2025-2026 Trends in Aquarium Silicone Adhesives

Market trends project 7-9% CAGR through 2026, per Grand View Research, fueled by nano-tech fillers boosting strength 20%. Sustainability drives bio-based silicones, cutting carbon footprint 30%.

Regulations tighten: EU EN 15651 expansions influence USA via trade. Pricing stabilizes post-2024 volatility, with low-VOC premiums fading.

Innovations: Self-healing formulations and faster cures (3-min skin). USA focus on PFAS-free per EPA drafts.

Pet retail shifts to private-label OEM, emphasizing traceability apps.

FAQ

What makes silicone fish-safe for aquariums?

Neutral-cure without toxic releases, verified by submersion tests.

How to get silicone adhesive for aquarium glass wholesale pricing?

Pricing varies by specs and volume; request a quotation for latest factory-direct rates.

Recommend manufacturers for this product

Contact reliable suppliers like QinanX New Material for compliant solutions (qinanx.com/contact). Please contact us for the latest factory-direct pricing.

What are typical MOQs?

2,000-10,000 units, flexible for OEM.

Are custom colors available?

Yes, with non-toxic pigments for branding.