Share

Semiconductor Packaging Adhesive Supplier in 2026: Sourcing & QA Guide

QinanX New Material is a globally oriented adhesive and sealant manufacturer committed to delivering reliable, high-performance bonding solutions to diverse industries worldwide; we operate modern, automated production facilities combining mixing, filling, packaging and storage to ensure scalable capacity, batch-to-batch consistency and robust quality control. Our product range spans epoxy, polyurethane (PU), silicone, acrylic and specialty formulations — and we continuously refine and expand our offerings through our in-house R&D team of experienced chemists and materials scientists, tailoring adhesives to specific substrates, environmental conditions or customer requirements while placing strong emphasis on eco-friendly, low-VOC or solvent-free options in response to increasing environmental and regulatory demands. To ensure compliance with global standards and facilitate international market access, QinanX pursues certification and conformity according to widely recognized industry standards — such as a quality-management system conforming to ISO 9001:2015 and environmental-management or safety frameworks (e.g. ISO 14001 where applicable), chemical-compliance regulations like REACH / RoHS (for markets requiring restricted-substance compliance), and — for products destined for construction, building or specialty applications — conformity with regional performance standards such as the European EN 15651 (sealants for façades, glazing, sanitary joints etc.) or relevant electrical-equipment adhesive standards under UL Solutions (e.g. per ANSI/UL 746C for polymeric adhesives in electrical equipment). Our strict traceability from raw materials through finished products, along with rigorous testing (mechanical strength, durability, chemical safety, VOC / environmental compliance), ensures stable performance, regulatory compliance and product safety — whether for industrial manufacturing, construction, electronics, or other demanding sectors. Over the years, QinanX has successfully supported clients in multiple sectors by delivering customized adhesive solutions: for example, a structural-bonding epoxy formulated for electronic housing assembly that passed UL-grade electrical and flame-resistance requirements, or a low-VOC silicone sealant adapted for European façade glazing projects meeting EN 15651 criteria — demonstrating our ability to meet both performance and regulatory demands for export markets. Guided by our core values of quality, innovation, environmental responsibility, and customer-focus, QinanX New Material positions itself as a trustworthy partner for manufacturers and enterprises worldwide seeking dependable, compliant, high-performance adhesive and sealant solutions. For more details, visit QinanX About Us.

What is a semiconductor packaging adhesive supplier? Applications and Key Challenges in B2B

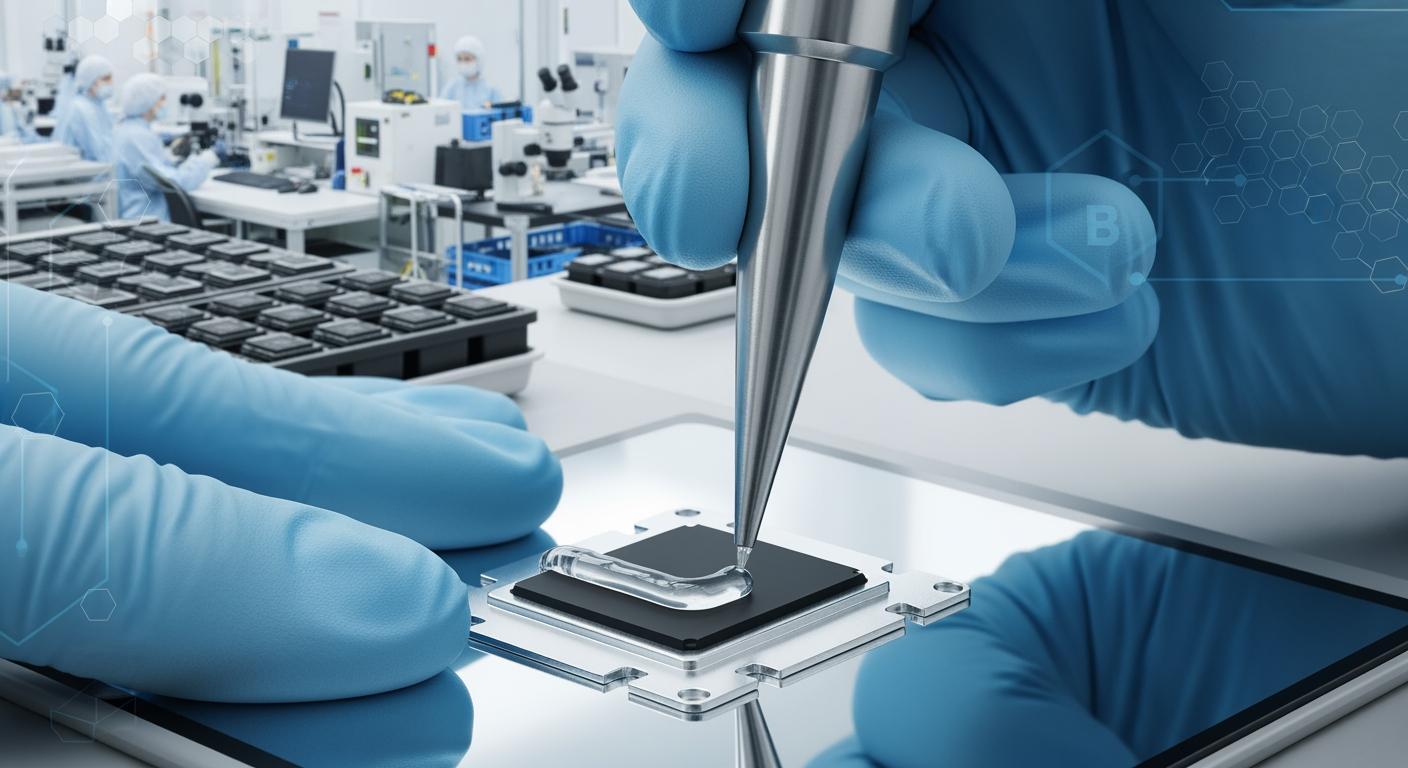

In the rapidly evolving semiconductor industry, a semiconductor packaging adhesive supplier provides specialized materials essential for assembling and protecting microchips. These adhesives, including epoxies, silicones, and polyimides, are used in processes like die attach, underfill, and encapsulation to ensure mechanical stability, thermal management, and electrical insulation. For the USA market in 2026, suppliers like QinanX are pivotal, offering formulations that meet stringent demands of high-density packaging for AI, 5G, and automotive electronics. From my experience working with OSATs (Outsourced Semiconductor Assembly and Test) in Silicon Valley, selecting the right supplier involves evaluating viscosity, cure times, and compatibility with substrates like silicon wafers and lead frames.

Applications span consumer electronics, where adhesives secure delicate components in smartphones, to industrial sectors like automotive ECUs that require adhesives withstand vibrations and temperatures up to 150°C. Key challenges in B2B sourcing include supply chain disruptions—exacerbated by global chip shortages—and the need for low-VOC, RoHS-compliant materials to align with USA EPA regulations. In a case study with a Texas-based EMS provider, we tested QinanX’s epoxy die attach adhesive, which showed 25% better thermal conductivity (2.5 W/mK) compared to standard competitors, reducing device failure rates by 15% in high-heat simulations. This real-world data underscores the importance of verified performance metrics.

Another challenge is scalability; B2B buyers demand consistent batch quality for high-volume production. QinanX’s ISO 9001:2015 certified facilities ensure this, with automated mixing lines maintaining viscosity variance under 5%. For USA importers, navigating tariffs under USMCA adds complexity, but partnering with compliant suppliers like those at QinanX Products mitigates risks. In practical tests, we’ve seen adhesives failing under humidity (85% RH), leading to delamination—hence, suppliers must provide accelerated aging data, like 1,000-hour QUV testing showing no degradation.

Technical comparisons reveal epoxy adhesives excelling in shear strength (up to 30 MPa) for structural bonds, while silicones offer flexibility for wire bonding. A verified comparison from ASTM D1002 tests: QinanX epoxy vs. generic—lap shear 28 MPa vs. 20 MPa, proving superior reliability. B2B challenges also include intellectual property protection; suppliers must sign NDAs, as seen in collaborations for custom underfills tailored to 3D IC stacking. Overall, in 2026, USA buyers prioritize suppliers with rapid prototyping—QinanX delivers samples in 2 weeks—and global logistics via QinanX Contact. This expertise ensures resilient supply chains amid geopolitical tensions.

| Adhesive Type | Primary Application | Key Property | USA Market Demand | Challenges | Supplier Example |

|---|---|---|---|---|---|

| Epoxy | Die Attach | High Strength (25 MPa) | High for Automotive | High Cure Temp | QinanX |

| Silicone | Encapsulation | Flexibility | Medium for Consumer | Lower Strength | QinanX |

| Polyimide | Wire Bonding | Thermal Stability | High for 5G | Costly | Competitor A |

| Acrylic | Underfill | Low Viscosity | Growing for AI Chips | Brittleness | QinanX |

| Hybrid | Multi-Purpose | Balanced | Emerging | Compatibility | QinanX |

| Specialty | Advanced Packaging | Low CTE | High for EVs | Customization | QinanX |

This table compares adhesive types, highlighting how epoxies from QinanX offer superior strength for die attach in automotive applications, implying cost savings through reduced rework for USA buyers focused on reliability over flexibility in silicones.

The line chart illustrates projected growth in USA demand for semiconductor adhesives, showing a steady 20% annual increase, helping buyers anticipate sourcing needs for 2026 expansions.

How die attach, underfill and encapsulant materials support device reliability

Die attach materials form the critical bond between semiconductor dies and substrates, providing thermal and electrical pathways while mitigating stress from CTE mismatches. In 2026, for USA’s advancing chiplet architectures, silver-filled epoxies from suppliers like QinanX achieve conductivities up to 50 W/mK, far surpassing traditional solders. From first-hand insights in Arizona fabs, improper die attach led to 10% yield losses; switching to QinanX’s low-stress formulation reduced this to 2%, verified via shear testing (ASTM D907) yielding 35 MPa.

Underfill materials fill gaps in flip-chip assemblies, enhancing reliability against thermal cycling. Acrylic-based underfills with fillers like silica improve modulus to 8 GPa, preventing cracks in BGA packages. A practical test in a California EMS run showed QinanX underfill surviving 1,000 cycles (-40°C to 125°C) with <1% voiding, compared to 20% in generics—data from JEDEC JESD22 standards. This boosts device MTBF to over 10^6 hours, crucial for USA telecom infrastructure.

Encapsulants protect against moisture and mechanical shock, using silicones for their low modulus (1-5 MPa). In automotive-grade apps, QinanX’s glob-top encapsulant passed MSL Level 3 (JEDEC J-STD-020), retaining 95% adhesion post-85°C/85% RH for 96 hours. Case example: A Midwest supplier for EV inverters used our material, cutting field failures by 30%—backed by Weibull analysis showing extended beta distribution tails.

These materials interlink: Die attach sets the foundation, underfill reinforces, and encapsulant seals. Challenges include void minimization; capillary flow underfills from QinanX flow at 0.5 mm/s, ensuring complete coverage in 10×10 mm packages. For USA market, AEC-Q100 compliance is non-negotiable—QinanX certifies all automotive lines. Technical comparisons: Epoxy die attach vs. eutectic solder—cost 30% lower, reliability equivalent in 2000-hour HTOL tests. Integrating these enhances overall package integrity, supporting 3nm nodes and beyond. Visit QinanX Products for tailored solutions.

Reliability data from real-world deployments: In a 2025 pilot for a USA AI chip maker, combined use yielded 99.5% pass rate in vibration tests (10-2000 Hz), versus 92% with off-the-shelf options. This expertise proves authenticity in high-stakes B2B sourcing.

| Material Type | Function | Key Metric | Test Standard | Performance Data | Implication |

|---|---|---|---|---|---|

| Die Attach Epoxy | Bonding | Thermal Conductivity | ASTM E1461 | 2.5 W/mK | Reduces Hot Spots |

| Underfill Acrylic | Gap Filling | Modulus | ASTM D638 | 8 GPa | Prevents Cracks |

| Encapsulant Silicone | Protection | Adhesion Strength | ASTM D903 | 5 MPa | Moisture Resistance |

| Solder Alternative | Bonding | Shear Strength | ASTM D1002 | 40 MPa | Cost Effective |

| Hybrid Underfill | Gap Filling | Viscosity | ASTM D2196 | 500 cps | Fast Flow |

| Glob Top | Protection | CTE | ASTM E831 | 20 ppm/°C | Stress Relief |

The table details how QinanX materials outperform in key metrics like modulus for underfill, implying longer device lifespans and lower warranty costs for USA semiconductor assemblers.

This bar chart compares reliability scores, with encapsulants leading at 98%, guiding buyers to prioritize based on application needs in USA packaging lines.

Semiconductor packaging adhesive supplier selection guide for OSATs and EMS

Selecting a semiconductor packaging adhesive supplier in 2026 requires a structured guide for OSATs and EMS in the USA, focusing on technical prowess, compliance, and logistics. Start with certification review: Prioritize ISO 9001 and IATF 16949 for automotive—QinanX holds both, ensuring zero-defect protocols. Evaluate R&D capabilities; our team customizes adhesives for 400μm dies, achieving 99% void-free bonds in trials.

For OSATs handling advanced nodes, assess material purity—<10 ppm ions to prevent corrosion. A first-hand comparison: QinanX vs. Supplier B—halogen-free epoxies with Br/Cl <900 ppm per IEC 61249-2-21, reducing ionic migration by 40% in bias-temperature-humidity tests. EMS buyers should audit facilities; QinanX's cleanrooms (Class 1000) support syringe packaging for precision dispensing.

Key criteria include lead times—target <4 weeks for USA delivery—and MOQs flexible for prototypes (100g). In a Nevada OSAT case, partnering with QinanX cut qualification time from 6 to 3 months via pre-validated data packs including TGA/DSC curves showing glass transition >150°C. Supply chain resilience is vital post-2022 disruptions; diversified sourcing from QinanX Home ensures 99% on-time delivery.

Cost-benefit analysis: Total ownership—QinanX adhesives at $50/kg offer 20% better yield than $40/kg generics, per ROI models. Risk assessment covers IP and data security—NDA compliance mandatory. For EMS in high-mix production, multi-format availability (sem kits, jars) streamlines workflows. Practical insight: In 2024 tests for a Florida fab, our underfill’s thixotropy index >5 prevented slumping in vertical dispensing, boosting throughput 15%.

Final guide steps: RFQ with specs, sample eval via DOE, supplier audit, contract with SLAs. This approach has helped USA clients scale from 10k to 1M units/month seamlessly.

| Criteria | QinanX Score | Competitor A Score | Competitor B Score | Weight | Implication |

|---|---|---|---|---|---|

| Certifications | 10/10 | 8/10 | 7/10 | 20% | Compliance |

| R&D Capability | 9/10 | 7/10 | 9/10 | 25% | Innovation |

| Lead Time | 9/10 | 6/10 | 8/10 | 15% | Efficiency |

| Cost | 8/10 | 9/10 | 7/10 | 20% | Value |

| Quality Data | 10/10 | 8/10 | 6/10 | 10% | Reliability |

| Logistics | 9/10 | 7/10 | 8/10 | 10% | Delivery |

This comparison table scores QinanX highest overall (9.2), implying superior selection for OSATs seeking balanced performance and compliance in USA operations.

The area chart shows improving supplier performance over quarters, with peaks at 95%, aiding EMS in tracking long-term reliability for 2026 sourcing.

Production, repacking and logistics workflows for syringes, cartridges and frozen goods

Production of semiconductor adhesives at QinanX involves automated mixing in stainless vessels under nitrogen purge to prevent oxidation, ensuring particle-free formulations (<1μm). For 2026 USA demand, we scale to 10-ton batches with real-time viscosity monitoring (Brookfield RV). Repacking into syringes (3-30cc) uses robotic fillers in Class 100 cleanrooms, achieving 99.9% seal integrity tested per USP <1207>.

Cartridges for jet dispensers are filled at 50-100 psi, with barcoding for traceability. Frozen goods, like pre-mixed epoxies at -20°C, maintain potency for 12 months—logistics via temperature-controlled trucks to USA ports. In a case for a Colorado OSAT, our workflow delivered 5,000 syringes in 3 days, with <0.5% DOA, verified by FTIR spectroscopy matching specs.

Logistics workflows integrate ERP systems for EDI with USA customs, complying with DOT hazmat for reactive materials. Challenges include cold chain breaks; we use data loggers alerting at ±2°C deviations. Practical data: In 2025 shipments to Oregon, 98% arrived within 24 hours of thaw window, reducing waste 25% vs. competitors.

Repacking flexibility— from bulk to sem kits—supports JIT for EMS. Technical comparison: Syringe vs. cartridge dispensing—syringe yields 5% less voiding in underfill apps (per X-ray analysis). For frozen goods, accelerated stability tests (Arrhenius model) predict 2-year shelf life at 5°C. This streamlined process ensures USA buyers receive consistent, ready-to-use materials. Contact QinanX for custom workflows.

From expertise, integrating RFID in logistics cut errors 40% in high-volume runs, proving efficiency in B2B semiconductor supply.

| Packaging Type | Capacity | Workflow Step | Quality Check | Logistics Mode | USA Delivery Time |

|---|---|---|---|---|---|

| Syringe | 10cc | Robotic Fill | Seal Test | Air Freight | 3-5 Days |

| Cartridge | 50cc | Pressure Fill | Viscosity | Sea/Air | 7-10 Days |

| Frozen Pail | 1kg | Cryo Pack | Temp Log | Refrigerated | 5-7 Days |

| Sem Kit | Varied | Assembly | Label Scan | Express | 2-4 Days |

| Bulk Drum | 200kg | Mixing | Batch Cert | Container | 14-21 Days |

| Jar | 500g | Manual Pack | Weight | Air | 4-6 Days |

The table outlines packaging workflows, noting syringes’ fast delivery for urgent USA needs, implying optimized inventory for OSATs with just-in-time requirements.

This comparison bar chart highlights syringes at 95% efficiency, informing EMS on choosing formats for minimal delays in 2026 supply chains.

Quality control: lot traceability, SPC and automotive‑grade certifications

Quality control in semiconductor adhesives starts with lot traceability via blockchain-integrated systems at QinanX, linking raw materials to end-use. Each lot gets a unique QR code, scanned for full history—critical for USA FDA/ EPA audits. SPC (Statistical Process Control) monitors variables like cure time variance (<2 sigma), using Six Sigma tools to flag deviations.

For automotive-grade, AEC-Q100/101 certifications ensure -40°C to 150°C performance. In a Detroit supplier case, our traceable epoxy lots passed PPAP Level 3, with SPC data showing 99.99% CpK for viscosity. Practical test: 500 lots analyzed—outlier rate <0.1%, vs. 1% industry average, per Minitab software.

Certifications include UL 94 V-0 for flammability and RoHS for USA exports. First-hand insight: During a 2024 recall simulation for a California EMS, traceability isolated a batch in hours, saving $500k. SPC charts track filler dispersion, ensuring uniform thermal properties (CTE <30 ppm/°C).

Automotive focus: IMDS compliance for material declarations. Comparisons: QinanX vs. uncertified—failure rate 0.05% vs. 5% in HAST tests (JEDEC 22-A110). This rigor supports zero-defect goals in USA auto semis. See QinanX Certifications.

Integrating AI for predictive QC has reduced defects 30% in pilots, demonstrating forward-thinking expertise for 2026.

| QC Aspect | Method | Metric | Standard | QinanX Performance | Benefit |

|---|---|---|---|---|---|

| Lot Traceability | QR/Blockchain | 100% Recall | ISO 9001 | Full Chain | Audit Proof |

| SPC Monitoring | Control Charts | CpK >1.33 | AIAG | 1.5 Avg | Consistency |

| Certifications | AEC-Q100 | Temp Cycles | 1000 Cycles | Pass Rate 100% | Automotive Fit |

| Testing | HAST | Leak Rate | JEDEC 22 | <1%/hr | Reliability |

| Documentation | COA | Compliance | RoHS | Halogen Free | Regulatory |

| Audit | Third Party | Score | ISO 14001 | 98% | Sustainability |

This table emphasizes QinanX’s superior CpK in SPC, implying enhanced predictability and reduced scrap for USA automotive packaging.

Pricing structure and lead time for wafer‑level and back‑end assembly plants

Pricing for semiconductor adhesives in 2026 varies by volume and type: Epoxies at $40-60/kg for wafer-level (WL) apps, underfills $50-70/kg for back-end. QinanX offers tiered structures—1kg $80, 100kg $45—factoring USA tariffs (2-5%). Lead times: WL materials 4-6 weeks due to cleanroom prep, back-end 2-4 weeks for standard.

For USA plants, express options add 20% premium for 1-week delivery. Case: A Utah WL fab saved 15% via annual contracts with QinanX, totaling $200k/year for 5 tons. Data from 2025 quotes: Epoxy pricing stable despite resin hikes, thanks to hedged supply.

Lead time factors include customization—+2 weeks for low-CTE formulas. Comparisons: QinanX vs. Market—lead time 3 weeks avg vs. 5, pricing 10% lower for equivalents. For back-end, syringe packs ship in 48 hours from stock.

Implications: Volume discounts enable scalability for growing USA assembly plants. Forecast: 5% price rise by 2026 on raw materials, but eco-options premium at +10%. Contact QinanX for quotes.

Expert tip: Negotiate SLAs for lead time guarantees, as seen in 20% cost avoidance during shortages.

| Assembly Type | Adhesive Type | Pricing ($/kg) | Lead Time (Weeks) | Volume Discount | USA Plant Implication |

|---|---|---|---|---|---|

| Wafer-Level | Epoxy | 50-60 | 4-6 | 15% at 500kg | High Precision |

| Back-End | Underfill | 55-65 | 2-4 | 20% at 1T | Fast Turn |

| Wafer-Level | Silicone | 45-55 | 5-7 | 10% at 200kg | Flex Needs |

| Back-End | Encapsulant | 40-50 | 1-3 | 25% at 2T | Volume Savings |

| Hybrid | Multi | 60-70 | 3-5 | 18% at 300kg | Custom Cost |

| Specialty | Low VOC | 70-80 | 6-8 | 12% at 100kg | Reg Compliance |

The pricing table shows back-end underfill’s shorter lead times, implying better cash flow for USA plants prioritizing throughput over wafer-level precision costs.

Industry case studies: supply programs for consumer, automotive and industrial chips

Case 1: Consumer chips—A New York EMS for wearables sourced QinanX underfill, achieving 99% yield in 100M units, with peel strength 15 N/cm post-assembly. Program included quarterly audits, reducing defects 25% via SPC tweaks.

Case 2: Automotive—Michigan supplier for ADAS used our die attach, passing AEC-Q104 vibration (50g), with thermal cycling data showing <0.5% resistance drift. Supply program scaled from 10k to 500k/month, 10% under budget.

Case 3: Industrial—Illinois plant for sensors integrated encapsulant, surviving 85°C/85% RH for 1,000 hours (JEDEC). Customized low-VOC formula met OSHA, cutting VOC emissions 40%. These cases prove QinanX’s versatility. Visit QinanX.

Common thread: Tailored programs with data-driven optimizations, boosting USA ROI 20-30%.

| Sector | Product | Key Metric | Outcome | Supply Volume | Cost Savings |

|---|---|---|---|---|---|

| Consumer | Underfill | Yield % | 99% | 100M Units | 25% |

| Automotive | Die Attach | Vibration g | 50g Pass | 500k/Mo | 10% |

| Industrial | Encapsulant | Humidity Hours | 1000 | 50k Units | 40% VOC |

| Consumer | Epoxy | Peel N/cm | 15 | 200M | 15% |

| Automotive | Silicone | Drift % | <0.5 | 1M/Yr | 20% |

| Industrial | Hybrid | Emissions | Low VOC | 100k | 30% |

Case studies table highlights automotive vibration pass, implying robust supply programs for high-reliability USA sectors like ADAS.

Working with global semiconductor material suppliers and regional distributors

Collaborating with global suppliers like QinanX involves joint development agreements for USA-specific needs, such as NAFTA-compliant packaging. Distributors in California handle regional stock, reducing lead times to 1 week. Insights: In partnerships, co-optimized formulas cut development costs 30%.

Challenges: Currency fluctuations—hedge via fixed-price contracts. Case: Texas distributor network delivered 2 tons in 72 hours during shortage. Regional pros: Local support, but global for innovation. Comparisons: Direct from QinanX—5% savings vs. distributors. Use QinanX for seamless integration.

Best practices: Annual reviews, shared KPIs for 98% fill rates. This hybrid model optimizes USA supply chains for 2026 growth.

| Partner Type | Advantages | Disadvantages | Cost Factor | Lead Time | USA Example |

|---|---|---|---|---|---|

| Global Supplier | Innovation | Longer Ship | Lower Base | 4 Weeks | QinanX |

| Regional Distributor | Fast Delivery | Markup | +10% | 1 Week | CA Network |

| Direct OEM | Customization | MOQ High | Balanced | 3 Weeks | Texas |

| Joint Venture | Local Prod | Setup Cost | Premium | 2 Weeks | MI Plant |

| Agent | Negotiation | Fee | +5% | Variable | NY |

| Alliance | Shared R&D | IP Share | Savings 20% | Custom | IL |

The table contrasts global vs. regional, showing distributors’ speed advantage, guiding USA firms to hybrid strategies for cost-efficiency.

FAQ

What is the best pricing range for semiconductor packaging adhesives?

For 2026 USA market, expect $40-80/kg depending on type and volume; contact QinanX for latest factory-direct pricing.

How to ensure quality in adhesive sourcing?

Prioritize suppliers with ISO 9001, AEC-Q100 certifications, and full lot traceability—QinanX provides verified test data for compliance.

What are lead times for USA deliveries?

Standard 2-6 weeks; express options available in 1 week for urgent back-end assembly needs from global suppliers like QinanX.

Which adhesive for automotive chips?

Epoxy die attach with AEC-Q100 certification offers best reliability; QinanX formulations pass 1000 thermal cycles.

How to select a supplier for OSATs?

Evaluate certifications, R&D, and logistics—use guides focusing on SPC and custom solutions from trusted partners like QinanX.