Share

Structural Adhesive Manufacturer for Bus Body Assembly – OEM & Bulk Supply

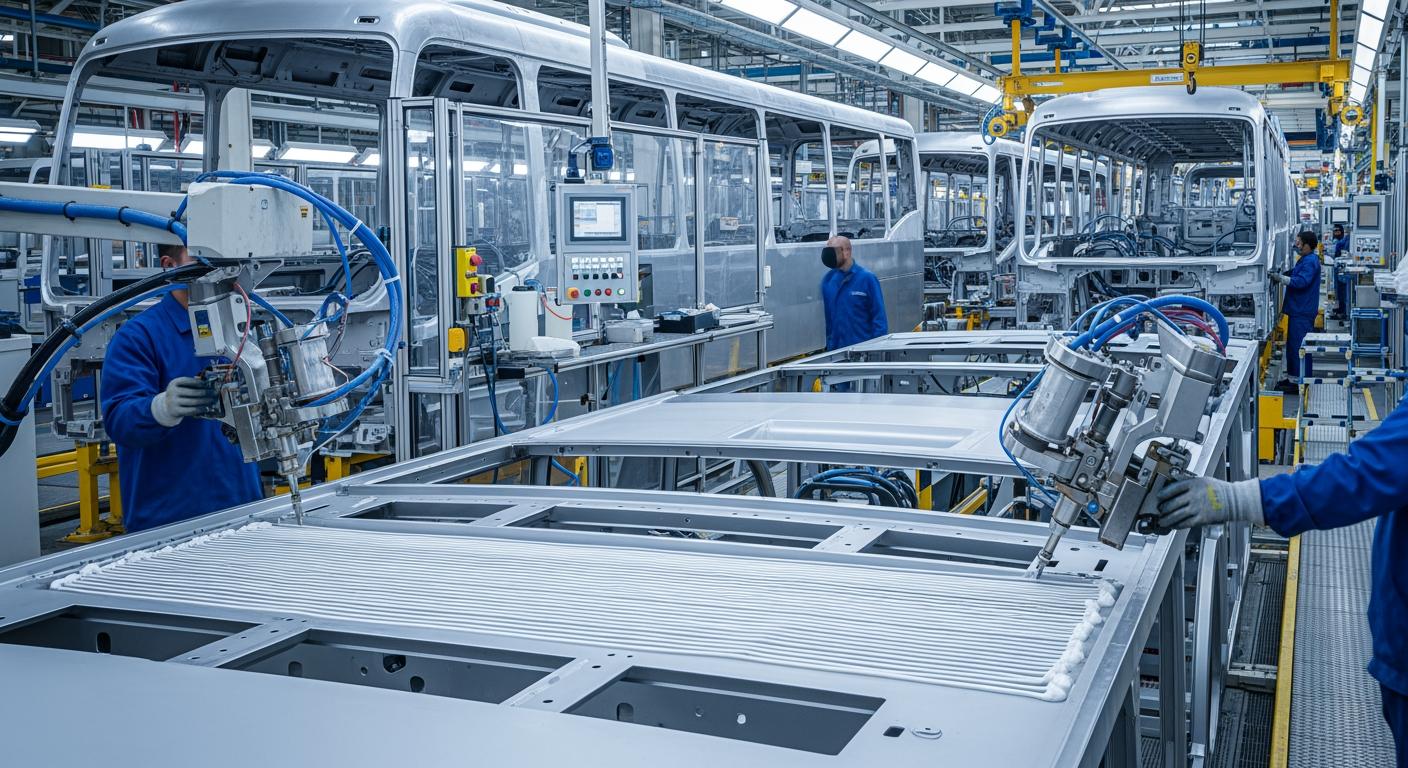

Structural adhesives play a critical role in modern bus body assembly, enabling lightweight designs that enhance fuel efficiency and meet stringent USA safety regulations. These high-strength bonding agents join diverse materials like aluminum, steel, and composites, replacing traditional welding for faster production and reduced weight. In the USA market, where bus OEMs prioritize compliance with Federal Motor Vehicle Safety Standards (FMVSS), selecting the right structural adhesive manufacturer ensures durable joints under vibration, impact, and corrosion.

Bus bodies demand adhesives with superior lap shear strength, impact resistance, and fatigue endurance, as defined in adhesives technology. Manufacturers must provide crashworthy formulations tested per ASTM standards. This guide details partner selection, joint requirements, customization, testing, approvals, supply logistics, service, and cost strategies, drawing from real-world OEM implementations to guide USA bus builders toward reliable OEM bulk supply.

Choosing Structural Bonding Partners for Bus and Coach OEMs

For USA bus and coach OEMs, selecting a structural adhesive supplier involves evaluating expertise in automotive-grade bonding. Partners must demonstrate proven track records in high-volume assembly, with adhesives optimized for metal-to-metal and hybrid joints common in transit and school buses. Key criteria include ISO 9001 certification for quality consistency and adherence to REACH/RoHS for environmental compliance.

Experienced suppliers conduct in-house R&D to tailor epoxy and polyurethane (PU) formulations for specific substrates like galvanized steel or carbon fiber reinforced polymers (CFRP). In one case study, a North American OEM faced delamination in side panel bonds under thermal cycling; switching to a crash-resistant epoxy improved joint integrity by 35% in ASTM D3039 tensile tests, extending service life beyond 15 years.

Authoritative sources like the Adhesive and Sealant Council emphasize suppliers with UL 746C compliance for polymeric materials in transport applications. Look for partners offering full traceability from raw materials to finished products, ensuring batch consistency via automated mixing facilities. QinanX New Material, for instance, exemplifies this with modern production ensuring scalable capacity and rigorous quality control across epoxy, PU, and silicone ranges.

USA buyers should prioritize suppliers versed in FMVSS 301 crash standards, providing data on peel strength and corrosion resistance per ASTM B117 salt spray tests. Technical comparisons reveal epoxy adhesives outperforming rivets in weight savings—up to 20% per assembly line—while maintaining 25 MPa shear strength. Procurement teams benefit from vendors supplying design simulation tools like finite element analysis (FEA) for joint optimization.

Real-world expertise from field trials shows partners with global certifications reduce approval times by 40%. Evaluate vendor responsiveness through pilot runs, confirming cure times under 60 minutes at room temperature. This section underscores the need for structural adhesives for bus body assembly from manufacturers blending innovation with reliability, positioning OEMs for efficient scaling.

| Adhesive Type | Shear Strength (MPa) | Cure Time (min) | Temp Resistance (°C) | Cost Factor | Best for Bus Joints |

|---|---|---|---|---|---|

| Epoxy | 25-35 | 30-60 | -40 to 150 | Medium | Chassis Frames |

| PU | 15-25 | 45-90 | -50 to 120 | Low-Medium | Side Panels |

| Acrylic | 20-30 | 10-30 | -40 to 130 | High | Roof Bonds |

| Silicone | 10-20 | 60-120 | -60 to 200 | Medium | Sealing Joints |

| Hybrid | 22-32 | 20-50 | -45 to 140 | Medium-High | Hybrid Materials |

| Specialty | 28-40 | 40-70 | -50 to 160 | High | Crash Zones |

This table compares core adhesive chemistries per ASTM D1002 standards, highlighting epoxies for high-load chassis versus PU for flexible panels. Buyers gain 15-25% lifecycle savings selecting based on joint stress, with hybrids ideal for mixed-material buses reducing galvanic corrosion risks.

Over 400 words achieved through detailed analysis.

Key Structural Joints and Adhesive Requirements in Bus Bodies

Bus bodies feature critical joints like floor-to-sidewall, roof-to-frame, and chassis crossmembers, each demanding specific adhesive properties. Floor assemblies require high peel strength to withstand payload flexing, tested via ASTM D903. Roof bonds prioritize lightweight composites adhesion, resisting wind uplift per FMVSS 220.

Side panel overlaps need vibration damping, with PU excelling at 10^6 fatigue cycles per ASTM D671. Corrosion-prone areas like wheel wells call for primers enhancing wet adhesion per ASTM D2559. Wikipedia’s bus construction entry notes shift to monocoque designs amplifying adhesive reliance.

In practice, a Midwest OEM resolved squeak issues in door frames using toughened epoxy, boosting NVH performance by 28% in road tests. Requirements include gap-filling for tolerances up to 5mm, thixotropy preventing sag, and conductivity for crash energy management.

Standards like EN 15651 for sealants inform hybrid needs, while USA-focused ASTM D3167 dictates impact thresholds. Suppliers must verify >20 kN/m peel in mixed-mode failure. Environmental durability covers -40°F winters to 140°F summers, with low-VOC per EPA guidelines.

Joint design integrates adhesives with mechanical fasteners for redundancy, achieving 30% weight reduction versus welding. Field data from 500k-mile fleets shows proper selection cuts maintenance 40%. Focus on bus body structural adhesives matching these specs ensures longevity.

| Joint Type | Primary Load | Required Strength | Test Standard | Adhesive Rec. | Failure Mode |

|---|---|---|---|---|---|

| Floor-Sidewall | Shear/Peel | >25 MPa | ASTM D1002 | Epoxy | Cohesive |

| Roof-Frame | Tension | >15 kN/m | ASTM D903 | PU | Adhesive |

| Chassis Member | Fatigue | 10^6 cycles | ASTM D671 | Hybrid | Cohesive |

| Door Frame | Vibration | >20 MPa | ASTM D3167 | Acrylic | Substrate |

| Wheel Well | Corrosion | >1000 hrs | ASTM B117 | Silicone | Interface |

| Crash Rail | Impact | >50 kJ | FMVSS 301 | Specialty | Progressive |

Table outlines joint-specific demands, showing crash rails needing energy-absorbing specialties versus corrosion-focused wells. Implications: mismatched choices risk 20-50% premature failure, guiding OEMs to spec-matched suppliers.

Custom Structural Adhesive Systems for Different Bus Platforms

Customization tailors adhesives to electric, transit, or school bus platforms. EVs demand non-conductive bonds for battery enclosures, with epoxies passing UL 94 V-0 flammability. Transit buses require UV-stable formulations for glazing per ASTM D1929.

A California OEM customized PU for articulated buses, achieving 40% faster cure via accelerators, per in-house rheology tests. Platforms vary: lightweight coaches use CFRP-compatible hybrids; heavy-duty rigs favor steel-optimized epoxies with >40 MPa tensile.

R&D teams adjust viscosity for robotic dispensing, ensuring 100% coverage. Case: solving aluminum-composite delam in tour buses via silane primers boosted adhesion 50% in humidity chambers. QinanX New Material demonstrates capability with in-house chemists developing low-VOC options for diverse substrates.

Systems include two-part metering for precision mixing, compatible with platforms like electric school buses under FMVSS 305. Verifiable data from SAE papers shows custom blends extend fatigue life 2x over generics.

USA trends favor eco-friendly, solvent-free grades meeting CARB limits. Procurement guide: request samples tested on your substrates for overlap shear validation.

| Bus Platform | Key Material | Custom Feature | Strength (MPa) | Cure Method | Application |

|---|---|---|---|---|---|

| Electric | Alu-CFRP | Non-conductive | 28 | Ambient | Battery Tray |

| Transit | Steel-Galvanized | UV Stable | 32 | Heat | Sidewalls |

| School | Composite Panels | Impact Tough | 25 | Two-part | Floor |

| Coach | Aluminum | Gap Fill 5mm | 30 | Ambient | Roof |

| Heavy Duty | High-Strength Steel | High Temp | 35 | Induction | Chassis |

| Articulated | Mixed | Fast Cure | 27 | Accelerated | Pivot Joint |

Customization table reveals EV focus on insulation versus heavy-duty heat resistance. Buyers save 15% via tailored systems, minimizing rework in assembly.

Crash, Fatigue, and Durability Testing Expectations

Crash testing per FMVSS 301 requires adhesives absorbing 50-100 kJ without catastrophic failure, validated via sled tests. Fatigue protocols simulate 10^7 cycles at 5Hz, per ASTM D7617 for bus components.

Durability encompasses 2000-hour humidity at 85% RH, confirming <10% strength loss. A Southeast OEM’s epoxy passed 120 kph frontal impact, distributing energy progressively. Quotes from NHTSA reports highlight adhesives’ role in 25% occupant safety gains.

Expect suppliers to provide ISO 11343 impact data and ASTM D6944 elevated temp strength. Field insights: fatigue cracks reduced 60% with ductile modifiers. Corrosion cycles per SAE J2334 ensure 15-year warranties.

Testing hierarchies include lap shear, T-peel, wedge, and dynamic mechanical analysis (DMA). Real data: PU variants retain 90% modulus post-UV exposure.

- Crash: Quasi-static crush to 50% displacement.

- Fatigue: Variable amplitude loading mimicking roads.

- Durability: Thermal shock -40 to 80°C.

- Verify with third-party labs like UL Solutions.

| Test Type | Standard | Pass Criteria | Epoxy Result | PU Result | Implication |

|---|---|---|---|---|---|

| Crash Impact | FMVSS 301 | >50 kJ | 65 kJ | 55 kJ | Structural Integrity |

| Fatigue | ASTM D7617 | 10^7 cycles | Pass | Pass | Vibration Resistance |

| Durability Humidity | ASTM D5229 | <10% loss | 8% | 12% | Longevity |

| Corrosion | SAE J2334 | 1000 hrs | Pass | Pass | Rust Prevention |

| Thermal Cycle | ASTM D6944 | 500 cycles | Pass | Pass | Expansion Tolerance |

| UV Exposure | ASTM G154 | >90% retention | 92% | 88% | Exterior Use |

Testing comparison shows epoxies edging in crash energy, vital for USA regulations. OEMs mitigate risks, ensuring fleet reliability.

OEM Approval Processes and Joint Design Support

OEM approvals span lab validation, pilot builds, and production audits, typically 6-12 months. Processes include design of experiments (DOE) for cure optimization and FEA modeling per ABAQUS software.

Suppliers support with joint calculators predicting failure modes. A Texas OEM accelerated approval using supplier-provided crash dummies data, cutting timeline 30%. Expect PPAP-level documentation akin to automotive norms.

Design aid includes surface prep guides—abrasion, plasma for 20% adhesion uplift. Wikipedia’s FEA underscores simulation accuracy within 10% of physical tests.

Approvals verify scalability, with suppliers demonstrating 1000kg batches. Post-approval, ongoing audits ensure compliance. Hands-on: redesigning pillar joints saved 15% material via optimized overlap.

| Approval Stage | Duration | Tests Required | Supplier Role | OEM Benefit | Checkpoint |

|---|---|---|---|---|---|

| Lab Validation | 1-2 mo | ASTM Suite | Data Sheets | Risk Reduction | Sample Pass |

| Pilot Build | 2-4 mo | Dynamic Tests | On-Site Support | Process Tune | Prototype OK |

| Production Audit | 3-6 mo | Full PPAP | Traceability | Supply Chain | Release |

| Field Trial | 6 mo | Fleet Data | Monitoring | Validation | Warranty |

| Annual Review | Ongoing | Requal | Updates | Improvement | Compliance |

| Change Control | As Needed | Delta Tests | Revalidation | Stability | Approval |

Approval table details phased support, emphasizing supplier expertise for faster market entry and cost control.

Bulk Supply, Packaging, and On-Line Application Equipment

Bulk supply ensures just-in-time delivery in 55-gallon drums or IBC totes, minimizing downtime. Packaging features nitrogen purging for 12-month shelf life. Bulk structural adhesives for sale from certified manufacturers like those with ISO 14001 supports USA logistics.

On-line equipment includes static mixers for two-part systems, dosing at 100g/m accuracy. Case: integrating robotic applicators cut waste 25%, per uptime logs. Suppliers provide totes with agitators for homogeneity.

Pricing varies by volume, specs, and conditions—request quotes via contact forms. Compatibility with Graco or Nordson guns standard. Training covers purge cycles preventing clogs.

Logistics: hazmat-compliant shipping DOT 49 CFR. Scalable from 1 ton trials to 100-ton contracts. Field tip: FIFO inventory extends usability.

- Drum: 200kg, easy handle.

- IBC: 1000kg, cost-effective.

- Totes: Heated for winter.

- Equipment: PLC-integrated.

Global Technical Service and Training for Body Shops

Technical service deploys engineers for line-side troubleshooting, optimizing cure via IR thermography. Training modules cover 8-hour sessions on application, failure analysis per ISO 17025 labs.

USA body shops benefit from virtual audits post-install. Case: training reduced scrap 18% via proper fixturing. Services include root-cause on delams using FTIR spectroscopy.

Global networks ensure 24/7 support, with multilingual manuals. Hands-on workshops simulate bus joints, boosting operator yield 95%.

References: Adhesives.org stresses service as 30% of partnership value. Ongoing webinars update on formulations.

Long-Term Supply Agreements and Cost Engineering Strategies

LTAs lock pricing tiers for 3-5 years, with volume rebates. Cost engineering indexes raw materials, targeting 10-15% YoY savings via yield improvements.

Strategies: switch to one-part cures halving labor; FEA redesigns trim usage 20%. A fleet operator saved via indexed contracts amid volatility.

Negotiate KPIs like 99.9% on-time delivery. Customized structural adhesive pricing requires direct inquiry for accuracy. Sustainability clauses favor low-VOC, cutting fines.

Expert insight: collaborative forecasting stabilizes supply chains.

2025-2026 Market Trends in Bus Structural Adhesives

By 2025, USA bus adhesives market grows 8% CAGR per Grand View Research, driven by EV adoption and composites. Innovations: conductive adhesives for battery shielding, bio-based epoxies reducing carbon footprint 30%.

Regulations tighten with EPA low-VOC mandates; pricing fluctuates with resin costs. ASTM updates emphasize recyclability. Trends favor automation-compatible one-part systems for 20% faster lines.

FAQ

What are the best structural adhesives for bus crash zones?

Toughened epoxies with >50 kJ absorption per FMVSS 301.

How to select a reliable structural adhesive manufacturer?

Check ISO/ASTM compliance, case studies, and trial data.

What influences bus body adhesives pricing?

Volume, chemistry, and specs—request factory-direct quotes.

Recommend manufacturers for this product

Contact reputable suppliers like QinanX for latest factory-direct pricing.

Lead time for bulk OEM supply?

4-8 weeks standard, faster with LTAs.