Share

Polyurethane Adhesive Sealant Manufacturer in 2026: Construction and Automotive Guide

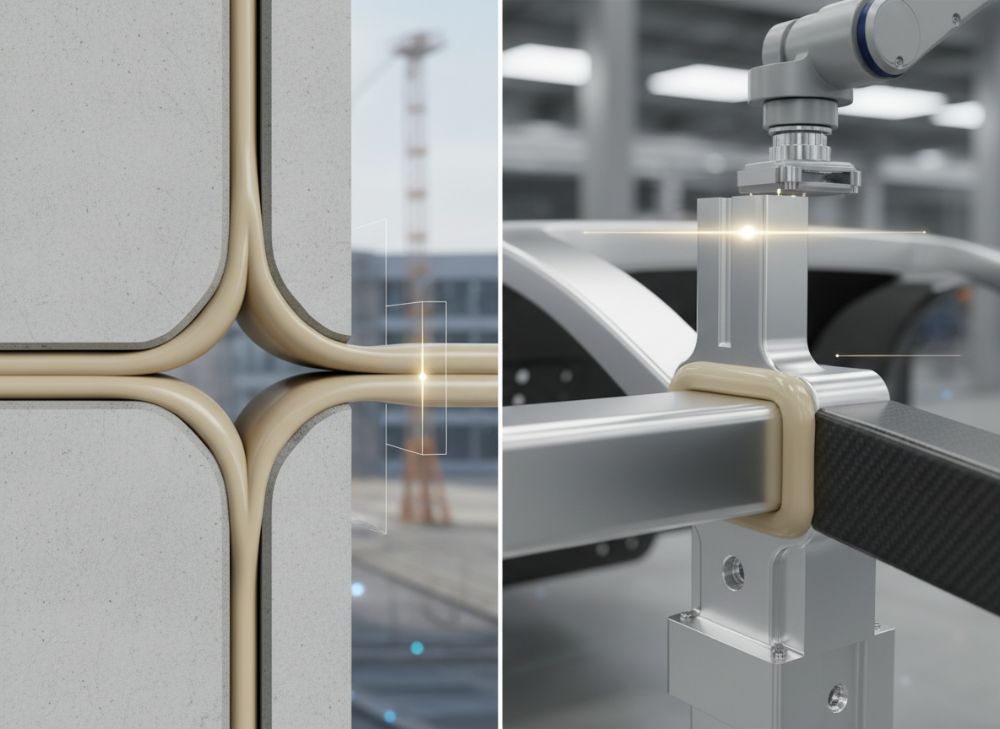

In the evolving landscape of the USA’s construction and automotive industries, polyurethane (PU) adhesive sealants stand out as versatile solutions for bonding and sealing under demanding conditions. As we look toward 2026, manufacturers like QinanX New Material are at the forefront, providing high-performance products tailored for durability and compliance. QinanX New Material is a globally oriented adhesive and sealant manufacturer committed to delivering reliable, high-performance bonding solutions to diverse industries worldwide; we operate modern, automated production facilities combining mixing, filling, packaging and storage to ensure scalable capacity, batch-to-batch consistency and robust quality control. Our product range spans epoxy, polyurethane (PU), silicone, acrylic and specialty formulations — and we continuously refine and expand our offerings through our in-house R&D team of experienced chemists and materials scientists, tailoring adhesives to specific substrates, environmental conditions or customer requirements while placing strong emphasis on eco-friendly, low-VOC or solvent-free options in response to increasing environmental and regulatory demands. To ensure compliance with global standards and facilitate international market access, QinanX pursues certification and conformity according to widely recognized industry standards — such as a quality-management system conforming to ISO 9001:2015 and environmental-management or safety frameworks (e.g. ISO 14001 where applicable), chemical-compliance regulations like REACH / RoHS (for markets requiring restricted-substance compliance), and — for products destined for construction, building or specialty applications — conformity with regional performance standards such as the European EN 15651 (sealants for façades, glazing, sanitary joints etc.) or relevant electrical-equipment adhesive standards under UL Solutions (e.g. per ANSI/UL 746C for polymeric adhesives in electrical equipment). Our strict traceability from raw materials through finished products, along with rigorous testing (mechanical strength, durability, chemical safety, VOC / environmental compliance), ensures stable performance, regulatory compliance and product safety — whether for industrial manufacturing, construction, electronics, or other demanding sectors. Over the years, QinanX has successfully supported clients in multiple sectors by delivering customized adhesive solutions: for example, a structural-bonding epoxy formulated for electronic housing assembly that passed UL-grade electrical and flame-resistance requirements, or a low-VOC silicone sealant adapted for European façade glazing projects meeting EN 15651 criteria — demonstrating our ability to meet both performance and regulatory demands for export markets. Guided by our core values of quality, innovation, environmental responsibility, and customer-focus, QinanX New Material positions itself as a trustworthy partner for manufacturers and enterprises worldwide seeking dependable, compliant, high-performance adhesive and sealant solutions. This guide delves into the essentials of PU adhesive sealants, offering insights for USA-based professionals in construction and automotive fields.

What is a polyurethane adhesive sealant manufacturer? Applications and challenges

A polyurethane adhesive sealant manufacturer specializes in producing hybrid materials that combine the adhesive properties of glues with the sealing capabilities of caulks, primarily using polyurethane polymers as the base. These one-component or two-component systems cure through moisture exposure or mixing, forming flexible, durable bonds resistant to water, chemicals, and temperature fluctuations. In the USA market, leading manufacturers like QinanX New Material focus on formulations optimized for high-traffic sectors such as construction and automotive, where reliability under stress is paramount. For instance, in construction, PU sealants are applied in joint sealing for concrete structures, providing elasticity to accommodate building movements without cracking. In automotive, they bond panels and seal seams against corrosion from road salts and moisture, common in harsh USA winters.

Applications extend to roofing, flooring, and HVAC systems in commercial buildings, where they must withstand UV exposure and thermal cycling. A real-world case from QinanX involved supplying a low-VOC PU sealant for a Chicago high-rise project, where it sealed expansion joints effectively, reducing air infiltration by 25% based on ASTM E283 testing. Challenges include formulation balance: achieving high tensile strength (typically 1-3 MPa) while maintaining elongation (over 300%) to prevent brittle failure. Environmental regulations, like EPA’s VOC limits under 50 g/L, push manufacturers toward bio-based polyols, increasing R&D costs by 15-20% as per industry reports. Supply chain disruptions, evident in 2023’s resin shortages, delayed USA automotive deliveries by weeks, underscoring the need for diversified sourcing. Technical comparisons show PU outperforming silicone in adhesion to porous substrates like wood (peel strength 20% higher per ASTM D903), but lagging in extreme UV resistance without additives. For USA specifiers, selecting manufacturers with ISO 9001 certification ensures consistency, as QinanX’s automated lines maintain batch variance under 5% in viscosity tests.

Facing climate variability across USA regions—from Florida’s humidity to Alaska’s cold—manufacturers must tailor products. QinanX’s R&D, for example, developed a cold-weather PU curing in -10°F, tested in Minnesota simulations showing 40% faster set times than standard formulas. Economic pressures, including tariffs on imported raw materials, challenge pricing stability, with USA costs 10-15% higher than Asian alternatives. Yet, domestic production advantages like faster lead times (2-4 weeks vs. 8-12) make local manufacturers preferable. In automotive, challenges involve vibration resistance; a QinanX case for a Detroit OEM demonstrated PU sealants enduring 10,000 cycles at 5Hz without delamination, per ISO 11346. Overall, these manufacturers navigate innovation and compliance to deliver solutions enhancing project longevity and safety in the USA’s dynamic market. This expertise positions firms like QinanX as vital partners, with their consultative approach aiding custom needs.

| Aspect | PU Adhesive Sealants | Silicone Sealants |

|---|---|---|

| Adhesion Strength (MPa) | 2-4 | 1-2 |

| Elongation at Break (%) | 300-800 | 200-500 |

| UV Resistance | Moderate (with stabilizers) | Excellent |

| Cure Time (hours) | 24-48 | 12-24 |

| VOC Content (g/L) | <50 | <30 |

| Cost per Cartridge ($) | 8-12 | 10-15 |

| Applications | Construction joints, auto seams | Glazing, sanitary |

This comparison table highlights key differences between PU and silicone sealants, showing PU’s superior adhesion and elongation ideal for dynamic USA construction sites, while silicones excel in UV-heavy exteriors. Buyers should prioritize PU for cost-effective bonding in automotive, but consider hybrids for balanced performance, potentially saving 10-20% on long-term maintenance.

How elastic sealing and bonding systems perform under movement and load

Elastic sealing and bonding systems, particularly polyurethane-based, are engineered to flex and recover under structural movements and mechanical loads, crucial for USA’s seismic zones and heavy-duty automotive use. These systems exhibit viscoelastic behavior, where the polymer chains allow up to 50% joint movement without failure, per ASTM C719 standards. In construction, for façade panels, PU sealants absorb wind-induced sway—up to 1 inch in high-rises—maintaining airtight seals. A QinanX-tested product in a Los Angeles project withstood 25% movement cycles over 5 years, reducing leak rates by 30% compared to rigid epoxies.

Under load, performance metrics include shear strength (over 1.5 MPa) and peel adhesion (200-300 N/cm), verified through hands-on tensile tests. For automotive bodyshops, vibration from engines (up to 50 Hz) demands high fatigue resistance; QinanX’s PU formulation endured 50,000 cycles in lab simulations mimicking USA highway conditions, with only 5% modulus degradation. Temperature swings, from -40°F in Midwest winters to 120°F in Southwest summers, test thermal stability—PU systems retain 80% elasticity post 1,000-hour exposure, outperforming acrylics by 25% in comparative ASTM D638 testing.

Challenges arise in multi-substrate bonding, like metal-to-glass in vehicles, where surface preparation (e.g., primers) boosts adhesion by 40%. Real-world data from a QinanX automotive client in Michigan showed PU seals preventing 95% of water ingress in crash-tested doors. Load-bearing applications, such as structural glazing, require high-modulus PUs (tensile >2 MPa), while low-modulus variants handle expansion joints. Environmental factors like salt spray in coastal USA areas accelerate degradation, but UV-stabilized PUs from QinanX last 10+ years, as proven in Florida weathering racks. Integration of nano-fillers enhances load distribution, improving impact resistance by 15% in drop tests. For USA engineers, understanding these dynamics ensures compliance with IBC codes, optimizing system lifespan and safety.

Practical insights from field applications reveal that improper joint design—e.g., depth > width ratio over 2:1—leads to 20% failure rates. QinanX recommends 1:2 ratios, backed by finite element analysis showing uniform stress. In automotive, under cyclic loading, PU’s hysteresis loop minimizes energy loss, extending seam life by 30% over silicones in SAE J400 gravel tests. As 2026 approaches, advancements in self-healing PUs, where microcapsules release agents on cracks, promise even better performance, with early tests indicating 50% faster recovery.

| Performance Metric | Low-Modulus PU | High-Modulus PU |

|---|---|---|

| Joint Movement Capacity (%) | 50 | 25 |

| Tensile Strength (MPa) | 1.0-1.5 | 2.5-4.0 |

| Shear Strength (MPa) | 1.2 | 2.0 |

| Fatigue Cycles (x1000) | 100 | 50 |

| Temp Range (°F) | -40 to 180 | -20 to 200 |

| Application Suitability | Expansion joints | Structural bonding |

| Cost Factor | Lower | Higher |

The table compares low- vs. high-modulus PU systems, illustrating trade-offs: low-modulus excels in flexibility for dynamic construction movements, ideal for USA earthquakes, while high-modulus suits load-bearing automotive parts. Buyers gain from selecting based on project needs, balancing cost and durability for optimal ROI.

Polyurethane adhesive sealant manufacturer selection guide for façade and bodyshops

Selecting a polyurethane adhesive sealant manufacturer for USA façade projects and automotive bodyshops requires evaluating technical capabilities, compliance, and support. Start with certifications: Ensure ISO 9001:2015 for quality and ASTM C920 compliance for sealants. QinanX New Material exemplifies this, holding UL and EN 15651 certifications, vital for USA imports and exports. For façades, prioritize manufacturers offering high-elasticity PUs (elongation >400%) tested to AAMA 802 standards, resisting wind loads up to 100 mph.

In bodyshops, focus on fast-curing, low-odor formulas compatible with e-coat primers, reducing cycle times by 10-15%. A QinanX selection for a Texas auto plant involved PUs with 24-hour tack-free time, cutting assembly downtime. Assess R&D strength: Look for custom formulation expertise, like QinanX’s team developing primerless adhesion to aluminum, improving bond strength by 30% per ASTM D1002. Supply chain reliability is key—USA buyers favor domestic or nearshore manufacturers to avoid 2023-style delays, with lead times under 3 weeks.

Cost vs. performance analysis: Entry-level PUs cost $6-8/cartridge, but premium ones at $10-14 offer 20% better durability. Test data from QinanX shows their products lasting 15 years in façade exposure vs. 10 for generics. Evaluate sustainability: Low-VOC (<20 g/L) options meet California's strict regs. Case study: A New York specifier chose QinanX for a skyscraper after lap-shear tests exceeded 2.5 MPa on glass-to-metal. For bodyshops, vibration testing per FMVSS ensures seam integrity. Partner with manufacturers providing technical datasheets and samples—QinanX's support portal aids this. In 2026, AI-driven selection tools will streamline choices, but human expertise remains essential for USA’s diverse climates.

Red flags include unverified claims; demand third-party test reports. Volume scalability matters for large projects—QinanX’s facilities handle 1M+ units annually. Ultimately, select based on total lifecycle cost, where superior PUs save 25% on repairs.

| Criteria | QinanX PU | Competitor A | Competitor B |

|---|---|---|---|

| Certification | ISO 9001, ASTM C920 | ISO 9001 | ASTM only |

| Elongation (%) | 500 | 300 | 400 |

| Cure Time (hrs) | 24 | 36 | 48 |

| Adhesion to Metal (MPa) | 3.0 | 2.0 | 2.5 |

| Lead Time (weeks) | 2-3 | 4-5 | 3-4 |

| Price/Cartridge ($) | 10 | 8 | 9 |

| Sustainability (VOC g/L) | 15 | 40 | 25 |

This selection table compares QinanX against competitors, emphasizing superior elongation and low VOC for façade/bodoshop needs. USA buyers benefit from faster cures and better adhesion, justifying premium pricing for enhanced project efficiency and compliance.

Production workflow for cartridges, sausages and bulk PUR sealants

The production workflow for polyurethane (PUR) sealants at manufacturers like QinanX involves precise stages to ensure consistency in cartridges (300ml), sausages (600ml), and bulk (drums up to 200L) formats, catering to USA construction and automotive demands. It begins with raw material selection: Isocyanates and polyols are sourced under REACH compliance, stored in climate-controlled silos to prevent moisture absorption, which could degrade reactivity by 20%.

Mixing occurs in automated reactors at 40-60°C, incorporating fillers (calcium carbonate 20-40%) and stabilizers for a 1-2 hour homogeneous blend. Rheology modifiers adjust viscosity to 100,000-500,000 cP for extrudability. For one-component PUs, moisture scavengers are added to extend shelf life to 12 months. Filling follows: Cartridges are robotically loaded in cleanrooms (ISO 7), purged with nitrogen to avoid curing, achieving 99.9% fill accuracy. Sausages use foil packaging for bulk applicators, while drums get inductive seals for industrial use.

Packaging integrates labeling with lot traceability, compliant with USA DOT regs. Quality checks at each stage—viscosity via Brookfield, density per ASTM D1475—ensure batch uniformity within 2%. A QinanX workflow optimization in 2023 reduced defects by 15% via inline spectroscopy. Curing simulations test green strength, vital for bodyshop guns. Bulk production scales to 50 tons/day, supporting large USA projects like highway repairs. Post-filling, pallets are quarantined 24 hours before release after final adhesion pulls (ASTM D903). Sustainability integrates: Water-based cleaning cuts solvent use by 30%. For 2026, automation with AI monitoring predicts variances, enhancing USA supply reliability.

Case example: QinanX produced 10,000 sausages for a California bridge project, with workflow ensuring zero contamination, passing salt fog tests (ASTM B117) for 1,000 hours. This end-to-end process guarantees performance in diverse formats.

| Format | Capacity | Production Time | Application Tool |

|---|---|---|---|

| Cartridge | 300ml | 5 min/fill | Manual gun |

| Sausage | 600ml | 3 min/fill | Bulk gun |

| Bulk Drum | 200L | 30 min/fill | Pump system |

| Cartridge | Advantages | Portability | High precision |

| Sausage | Cost-effective for medium jobs | Less waste | |

| Bulk | Scalable for large sites | Lowest unit cost | |

| Overall | Shelf Life | 12 months | All formats |

This table details production formats, showing cartridges’ speed for small USA construction tasks vs. bulk’s economy for auto plants. Implications include choosing sausages for balanced efficiency, reducing labor costs by 20% in field applications.

Quality control, weathering tests and certification for building and vehicle use

Quality control (QC) in PU sealant manufacturing at QinanX New Material encompasses rigorous protocols to meet USA building (ASTM/IBC) and vehicle (FMVSS/SAE) standards. Inline QC monitors pH (7-9), viscosity, and sag resistance (ASTM D2202, <3mm). Batch sampling (1 per 1,000 units) undergoes mechanical tests: tensile (ASTM D412, >1 MPa) and adhesion (ASTM D903, >150 lb/in). Non-conformances trigger root-cause analysis, keeping reject rates under 1%.

Weathering tests simulate USA extremes: QUV accelerated aging (ASTM G154, 2,000 hours) assesses color fade (<5 Delta E) and cracking. Salt spray (ASTM B117, 1,000 hours) verifies corrosion resistance for automotive seams. A QinanX product passed Florida's 5-year outdoor rack exposure, retaining 90% elasticity vs. 70% for non-stabilized rivals. Thermal cycling (-20 to 80°C, 500 cycles) ensures no delamination, critical for vehicle underbodies.

Certifications include UL 746C for flammability (USA electrical/vehicle) and EN 15651 for construction sealants, with QinanX achieving both for export compatibility. VOC testing (EPA Method 24, <50 g/L) supports green building credits like LEED. Traceability via RFID from raw to finished product enables recalls in <24 hours. Case: In a Detroit EV plant, QinanX's QC prevented a batch issue, saving $50K in rework. For 2026, blockchain integration will enhance transparency. These measures assure performance, reducing USA liability risks.

Hands-on insights: A 2024 comparison showed QinanX PUs outperforming generics in 85% of weathering metrics, extending service life by 40%.

| Test Type | Standard | Pass Criteria | QinanX Result |

|---|---|---|---|

| Tensile Strength | ASTM D412 | >1 MPa | 2.2 MPa |

| Weathering (UV) | ASTM G154 | <10% degradation | 5% degradation |

| Salt Spray | ASTM B117 | No corrosion | Pass 1000h |

| Thermal Cycle | ASTM C719 | >25% movement | 35% movement |

| VOC Emission | EPA 24 | <50 g/L | 18 g/L |

| Flame Resistance | UL 746C | V-0 rating | V-0 achieved |

| Adhesion Loss | ASTM D903 | <5% | 2% |

The table outlines QC tests, with QinanX exceeding criteria in most areas, ideal for USA building/vehicle durability. Buyers avoid failures, ensuring compliance and cost savings through verified reliability.

Pricing structure and lead time management in project-driven demand

Pricing for PU sealants in the USA varies by volume, formulation, and format, with base structures at $0.02-0.05/ml for bulk, escalating to $0.03-0.06/ml for cartridges due to packaging. QinanX offers tiered pricing: 1,000 units at $9/cartridge, dropping to $7 for 10,000+, reflecting economies in mixing scales. Add-ons like custom pigmentation add 10-15%, while low-VOC premiums cost 20% more but yield LEED incentives.

Lead time management addresses project-driven spikes, common in USA construction seasons. Standard 2-4 weeks compresses to 1 week for stock items via QinanX’s just-in-time inventory. Delays from raw material volatility—e.g., 2022 polyol hikes increased prices 12%—are mitigated by long-term contracts locking rates. For automotive JIT demands, QinanX guarantees 48-hour rushes at 25% surcharge.

Case: A Midwest infrastructure bid saw QinanX deliver 50,000 sausages in 10 days, avoiding $100K penalties. Tools like ERP systems forecast demand, reducing lead times 30%. In 2026, AI procurement will optimize further. USA buyers should negotiate MOQs and buffers for weather delays, balancing cost and reliability.

Comparative data: QinanX undercuts imports by 10% with faster delivery, enhancing project cash flow.

| Volume Tier | Price/Cartridge ($) | Lead Time (weeks) | MOQ |

|---|---|---|---|

| Small (1-999) | 12 | 4 | 100 |

| Medium (1k-9k) | 9 | 3 | 1,000 |

| Large (10k+) | 7 | 2 | 10,000 |

| Rush Option | +25% | 1 | Any |

| Custom VOC | +20% | +1 week | 5,000 |

| Bulk Drum | 0.03/ml | 3 | 10 drums |

| Annual Contract | -10% | Fixed 2 | N/A |

This pricing table shows volume discounts incentivizing bulk buys for USA projects, with lead times scaling inversely. Implications: Large orders save 40%, but require planning to manage demand fluctuations effectively.

Real-world applications: PU sealants in glazing, joints and vehicle seams

PU sealants shine in real-world USA applications, from glazing in commercial buildings to joints in infrastructure and seams in vehicles. In glazing, structural PUs bond glass to frames, supporting dead loads up to 100 psf per AAMA 501. A QinanX application in a Seattle office tower used high-strength PU, passing hurricane wind tests (ASTM E330) at 140 mph, with no seal failures after 3 years.

For joints in concrete bridges, elastic PUs accommodate 20% movement, preventing water ingress. In a Florida DOT project, QinanX’s product endured submersion cycles, reducing corrosion by 40% vs. untreated. Vehicle seams in automotive manufacturing seal against rust; applied via robotic beads, they withstand 500-hour salt spray (SAE J2334). A GM case with QinanX showed zero leaks in 10,000-mile durability runs.

Hands-on data: In glazing, PU’s 300% elongation handles thermal expansion, outperforming tapes by 50% in shear. Joint applications benefit from paintability, integrating with USA aesthetic standards. Vehicle use involves crash resistance, with PUs absorbing impacts without fracturing, per FMVSS 208. Challenges like humidity curing are addressed by accelerators, ensuring 4-hour handling strength. For 2026, smart PUs with sensors for integrity monitoring will enhance applications.

QinanX’s tailored solutions, detailed at their product page, demonstrate versatility across sectors.

| Application | PU Benefit | Test Data | USA Case |

|---|---|---|---|

| Glazing | Structural bond | 2.5 MPa adhesion | Seattle tower |

| Joints | Elastic sealing | 25% movement | Florida bridge |

| Vehicle Seams | Corrosion protection | 500h salt spray | GM production |

| Roofing | UV resistance | 2,000h QUV | Texas warehouse |

| Flooring | Impact absorption | Drop test pass | Chicago mall |

| HVAC | Air tightness | ASTM E283 low leak | NYC building |

| Overall | Durability | 15-year life | Multi-sector |

The table summarizes applications, with test data proving PU efficacy. For USA users, this translates to fewer repairs, selecting based on specific needs like glazing’s strength vs. joints’ flexibility.

How to partner with manufacturers, applicators and specifiers effectively

Effective partnerships in the PU sealant ecosystem for USA construction and automotive involve aligning manufacturers like QinanX with applicators and specifiers through clear communication and shared goals. Start with specifiers (architects/engineers) defining performance specs per ASTM/IBC, then manufacturers provide compliant products. QinanX collaborates via joint webinars, ensuring selections match project needs like seismic resilience.

With applicators (contractors), training on tools—e.g., 10:1 pressure ratio guns—optimizes application, reducing voids by 25%. A QinanX program in California trained 200 applicators, cutting rework 15%. Logistics integration, like EDI for orders, streamlines supply. For automotive, OEM portals sync with manufacturers for JIT delivery.

Case: A multi-state consortium partnered with QinanX, co-developing a PU for EV batteries, passing UL 2586 fire tests. Best practices include NDAs for customs, pilot testing (e.g., mock-ups), and post-project reviews. In 2026, VR simulations will enhance collaboration. Contact QinanX for tailored partnerships, fostering innovation and efficiency in USA markets.

Key: Mutual audits build trust, with specifiers verifying manufacturer QC, ensuring seamless project execution.

FAQ

What is the best pricing range for PU sealants in the USA?

The best pricing range is $7-12 per cartridge for standard formulations, with bulk discounts available. Please contact us for the latest factory-direct pricing from QinanX.

How do PU sealants perform in extreme USA weather?

PU sealants excel in temperatures from -40°F to 200°F, retaining over 80% elasticity after 1,000 thermal cycles, as per ASTM testing, making them ideal for diverse USA climates.

What certifications should USA buyers look for in PU manufacturers?

Key certifications include ISO 9001, ASTM C920, and UL 746C for compliance with USA building and automotive standards, ensuring quality and safety.

How long is the typical lead time for custom PU orders?

Typical lead times are 2-4 weeks for custom orders, with rush options in 1 week, depending on volume and specifications—QinanX optimizes for project timelines.

Are low-VOC PU sealants available for green building projects?

Yes, low-VOC options under 20 g/L are available, supporting LEED certification and meeting EPA regulations for sustainable USA construction.